Can We Make Fed Independence a Bigger Deal?

Seriously.

Americans’ financial security is under attack – and the threat is coming from an unprecedented political assault on our economic institutions. In recent weeks, President Trump and his allies have taken aim at the independence of the Federal Reserve and even the integrity of government economic data. These aren’t just insider fights over bureaucratic turf. They are direct threats to the personal finances and economic well-being of working and middle-class Americans. When the Fed’s independence erodes, everyday Americans often end up paying the price in higher costs and economic turmoil.

An Unprecedented Attack on the Fed

For the first time in the Federal Reserve’s 111-year history, a president is attempting to fire a sitting Fed governor – Dr. Lisa Cook. Trump announced on social media that he was removing Cook “for cause” over flimsy allegations of mortgage paperwork irregularities. Cook has flatly denied any wrongdoing and is fighting the ouster in court, calling it “unprecedented and illegal”. Legal experts agree the mortgage issue is just a pretext. “This is not about mortgage fraud. This is entirely about seizing control of the Fed,” Cornell law professor Robert Hocket, warned. Trump failed to bully Fed Chair Jerome Powell into cutting rates, so now he’s moving to purge the Fed’s leadership until he gets his way.

Why should ordinary Americans care who sits on the Fed’s board? Because a politicized Fed means higher prices, higher borrowing costs, and a shakier economy for everyone. The Federal Reserve was designed to make decisions based on data and long-term stability, insulated from short-term political pressures. In fact, research shows countries with weak central bank independence suffer significantly higher inflation rates.

Undermining the Fed's independence can drive up interest rates on mortgages, car loans, and credit cards. When investors suspect the central bank might sacrifice price stability for political reasons, they demand a risk premium. If markets start doubting the Fed's commitment to fighting inflation, they will require higher returns to compensate for the increased risk that their investments may lose value, which drives up interest rates across the economy. Imagine paying more for a bill that already takes up the majority of your paycheck, to subdue one man’s personal dissatisfaction with data that was a direct result of self-inflicted, volatile economic conditions.

Firing the Messenger

As if capturing the Fed weren’t enough, Trump also fired the nation’s top labor statistician. When the Bureau of Labor Statistics (BLS) reported disappointing job growth in July, Trump exploded, claiming without evidence that the numbers were “RIGGED… to make the Republicans, and ME, look bad.” He insisted the economy was actually “BOOMING” and summarily sacked BLS Commissioner Erika McEntarfer hours after the report came out. Never mind that McEntarfer, a respected economist, had been confirmed by an overwhelming bipartisan Senate vote to a fixed term through 2028. In Trump’s world, apparently no independent official is safe if their data punctures his preferred narrative.

Here again, the real victims are regular Americans. Firing the chief of a statistical agency for doing her job is an attack on the very idea that facts and data should guide our economic decisions. The Bureau of Labor Statistics produces the monthly jobs report that businesses use to decide whether to hire, workers use to gauge the job market, and the Fed uses to set interest rates. Undermining the credibility of this data is extraordinarily reckless.

If businesses suspect the jobs and inflation figures are manipulated, they’ll pull back on investments and hiring. Lenders may start charging a “political uncertainty” premium. Consumers will lose faith and tighten their belts. It’s a recipe for economic stagnation, all so a president can avoid hearing bad news.

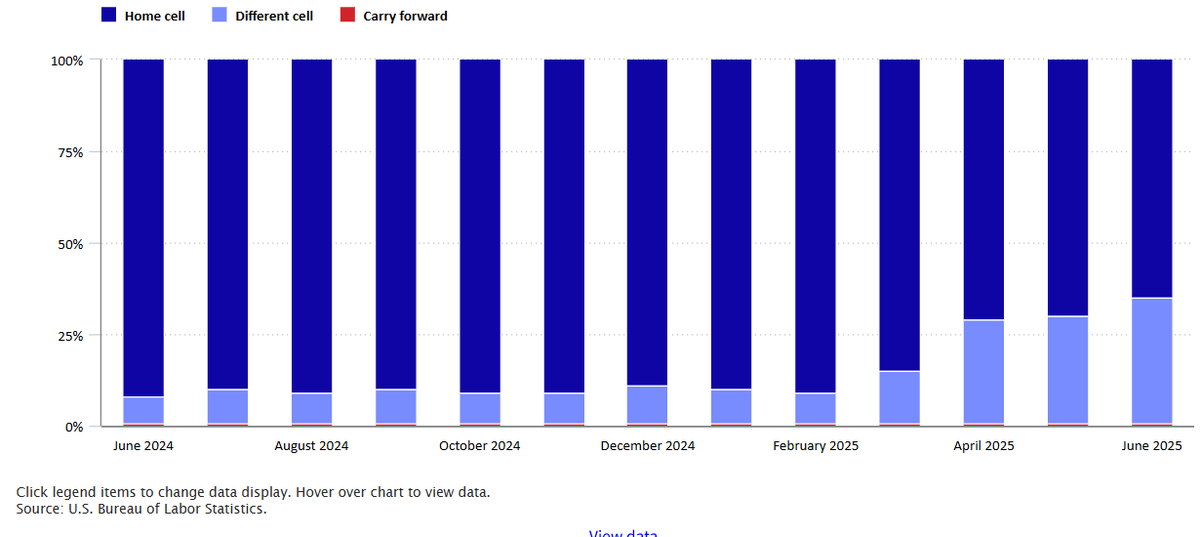

The attack on data is not happening in isolation. It comes on top of Congress starving statistical agencies of resources, for instance, budget cuts recently left the Bureau of Labor Statistics unable to collect nearly 20% of required price data. And as Bloomberg’s Tracy Alloway has pointed out, the problem is accelerating in shocking ways. In June, 35% of the Consumer Price Index was being imputed rather than directly observed, up from just 9% in February. That means over a third of America’s most important inflation gauge is now being estimated by judgment calls, not actual data collection. BLS officials themselves admitted that declining resources and a federal hiring freeze meant they could no longer send enough staff into the field to record prices.Taken together, illegal firings, defunding, and bullying of truth-tellers, we risk heading into the next economic storm flying blind. And when that storm hits, it’s ordinary families who will get drenched first.

Image Credit: Tracy Alloway

As Gary Winslett has noted on The Rebuild, this is all too eerily similar to the markings of Juan Perón’s playbook in Argentina, which led to chronic inflation, economic dysfunction, and lost prosperity. By undermining agencies like the Fed and BLS, pushing reckless tariffs and deficits, and politicizing economic data, Trump risks eroding investor confidence, raising costs for Americans, and setting the U.S. on a path toward long-term instability. And as he previously noted, we even have direct proof of what happens when the Chair of The Fed faces political pressures (spoiler alert, it isn’t good!):

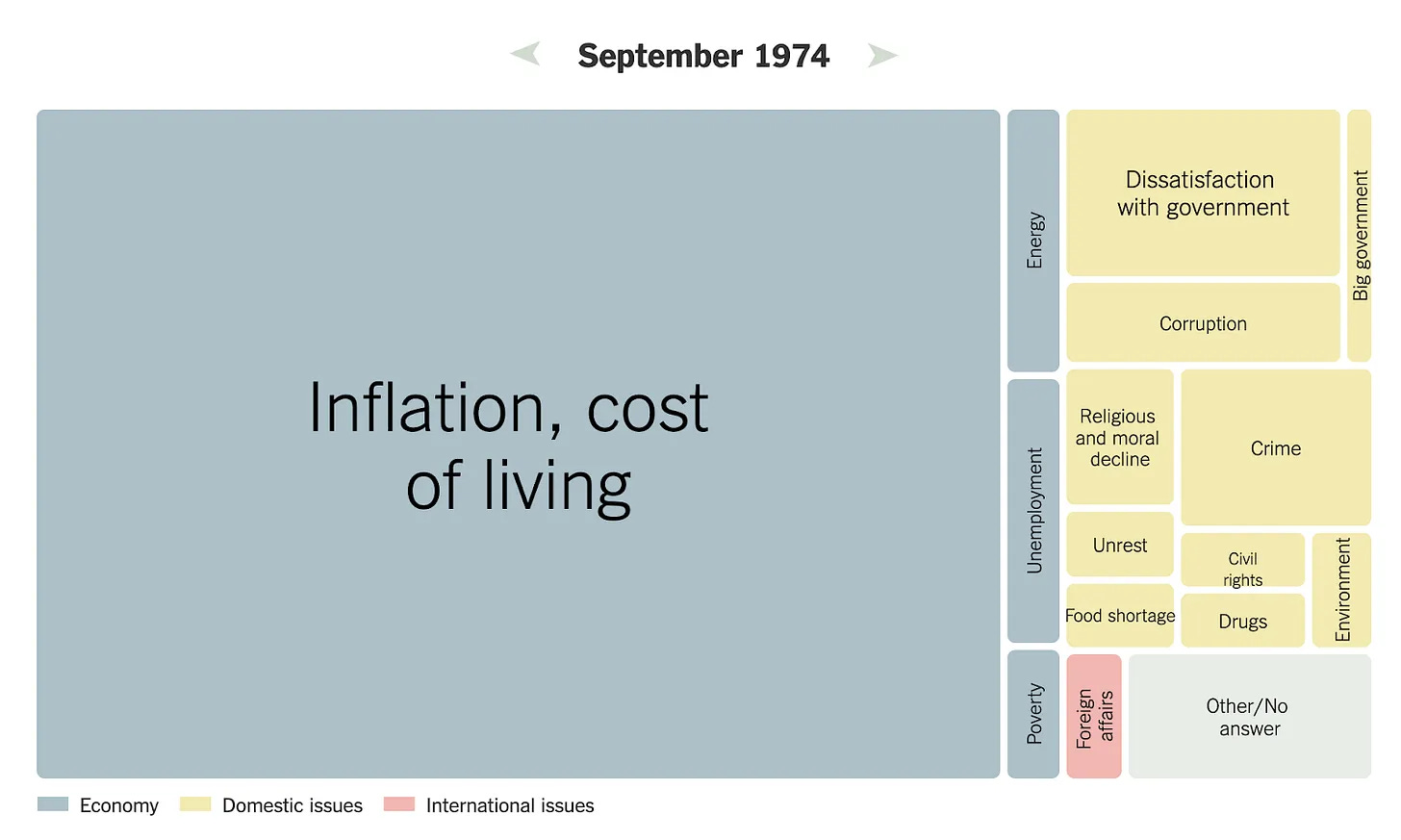

This is not some hypothetical problem. It is quite literally what happened in the 1970s. In 1971, President Nixon appointed Arthur Burns as Fed Chairman, and almost immediately began pressuring him to pursue expansionary monetary policies despite rising inflation. Nixon, focused on his 1972 reelection campaign, wanted low interest rates to stimulate short-term economic growth. Burns ultimately acquiesced, keeping monetary policy loose when it should have been tightening. The White House tapes later revealed Nixon explicitly telling Burns: "We'll take inflation if necessary, but we can't take unemployment." The result? Inflation skyrocketed to over 12% by 1974. The cost of living went from one of a number of concerns Americans had to the dominant national problem.

Image Credit: New York Times.

Democrats’ Deafening Silence

One would think these assaults on the Fed and basic economic data would set off alarm bells among those who claim to champion working Americans. Yet some Democratic leaders have been frustratingly timid in their response. House Minority Leader Hakeem Jeffries did speak up to condemn Trump’s baseless attempt to oust Lisa Cook, his statement discussed Trump’s “phony slander” of Cook’s character, and a focus on identity politics while barely touching on the broader economic danger. Jeffries did not clearly explain to the public that Trump’s Fed power grab could raise their mortgage payments or wipe out their 401(k)s.

Image Credit: Hakeem Jeffries

This is a baffling and troubling failure of messaging. Democrats right now are being painted as too slow to respond to crises and when they do, it at times feels like we are fighting a battle from nearly a decade ago. Republicans are literally threatening to blow up the pillars of our economy – independent rate-setting and trustworthy data – and many Democrats have yet to make it a cost of living issue. Every American with a credit card or a job should know that Trump’s schemes mean higher inflation and higher interest rates for them. Every retiree should know that politicizing the Fed puts their nest egg at risk. Where are the press conferences hammering this point? Where is the campaign to inform voters that these moves could tank the economy on Main Street, not just cause turmoil in Washington?

Democrats cannot afford technocratic complacency here. Yes, Fed independence and statistical integrity might sound wonky, but their collapse would be felt in every household’s budget. This is urgent, and it’s political malpractice not to sound the alarm. As Cameron Peters of Vox put it, Trump wants to “severely damage the long-term outlook of the US economy in service of his short-term political interests”. Democrats need to be shouting from the rooftops that they won’t let him get away with it.

Defending Independence = Defending Your Pocketbook

At its core, this fight isn’t about Lisa Cook or Erika McEntarfer as individuals – it’s about protecting the tools that keep our economy stable and fair. An independent Federal Reserve keeps partisan agendas from igniting runaway inflation or asset bubbles that eventually burst on ordinary people. Reliable statistics from agencies like the BLS keep our economic debates grounded in reality, so policies can be guided by facts. When those guardrails are sabotaged, the result is invariably economic pain for average families.

Democrats should treat this like the five-alarm fire that it is. Every time a Democrat gets in front of a microphone, they should be saying: “Trump is trying to cook the economy for his own gain, and you will pay the price if he succeeds.” Make it as central to the economic message as protecting Social Security or lowering drug prices. Because what could be more important than stopping a deliberate sabotage of the economy itself?

On a more positive note, Schumer had a more targeted response. He tied Trump’s attempted firing of Lisa Cook directly to the stakes for ordinary Americans, saying it “shreds the independence of the Fed and puts every American’s savings and mortgage at risk.” That framing translates an institutional crisis into an issue that impacts all Americans, making clear that if Trump succeeds, its families’ retirement accounts, home loans, and paychecks on the line. By warning that Trump is “playing a dangerous game of Jenga with a key pillar of our economy” and that Main Street would pay the price if the economy crashes, Schumer connected the dots between Fed independence and people’s everyday financial security. This is exactly the kind of messaging Democrats need to amplify if they want voters to grasp the urgency of what’s at stake.

Image Credit: Chuck Schumer

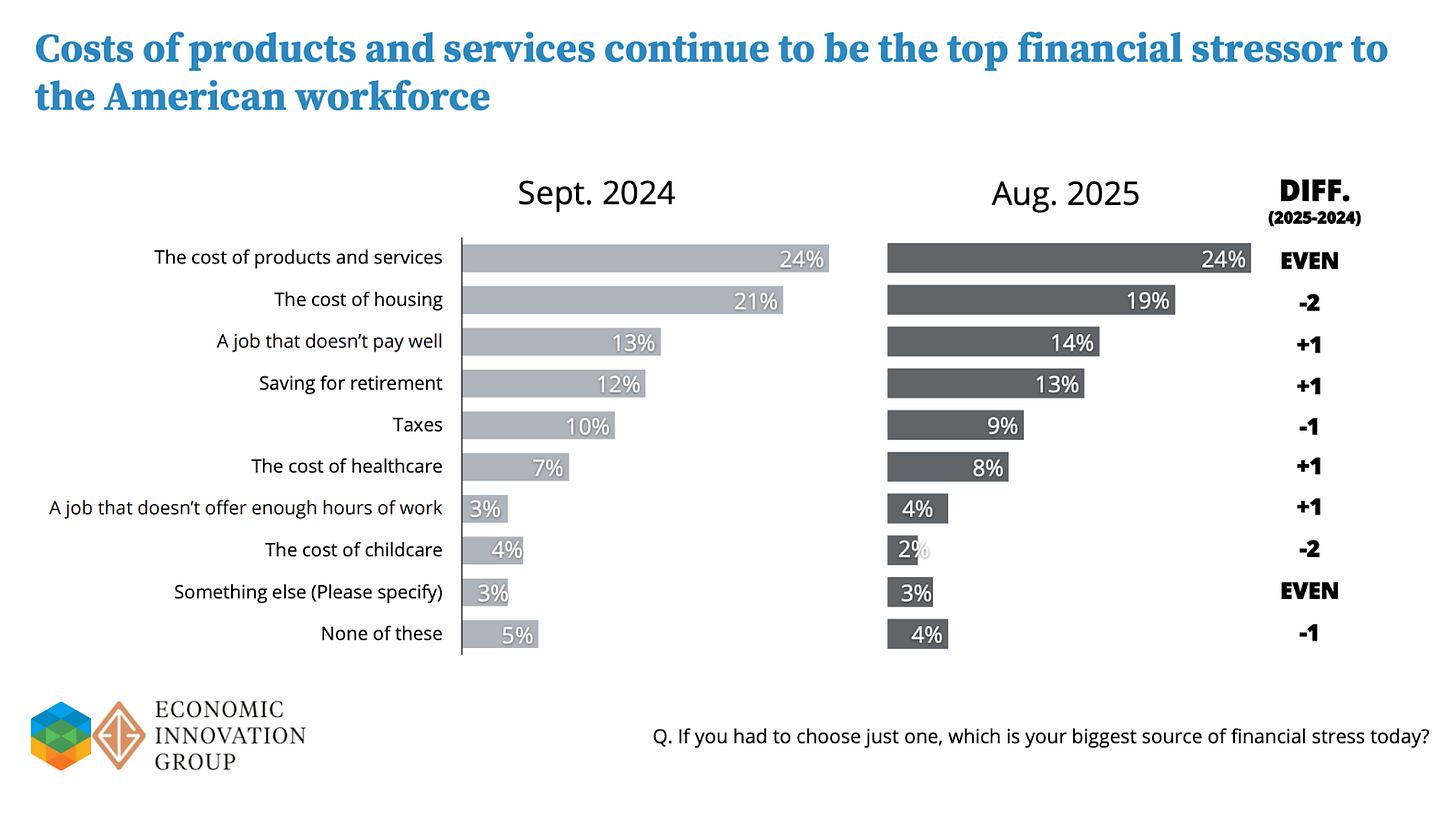

Fed independence might not be a poll-tested slogan, but sky-high inflation and lost jobs certainly are. As a recent survey by the Economic Innovation Group has noted, the top financial stressor for workers right now is the cost of products and services, with housing only following shortly behind.

Image credit: EIG

If Democratic leaders fail to connect the dots for the public, Trump will be able to explain away the narrative and worse, they’ll fail to avert a preventable economic disaster. It’s time to tell the hard truth: when the Fed and the facts are under attack, so are your finances. Trust in institutions is at an all time low, so the time to reframe the narrative is yesterday. Defending these institutions is about safeguarding your paycheck, your savings, and your future.

I have to disagree some about what national Democratic leaders say. I think you’re way overstating the importance of it. I’m all for Schumer and Jeffries denouncing what Trump is doing, but very few people have any idea who they are. What matters is what individual candidates in competitive races say. Democrats have already gotten some solid recruits and I have no doubt they will emphasize the cost of living. They may never mention the Fed by name, but they won’t need to.

If Trump succeeds in bullying the Fed to lower interest rates it will cause inflation to go up. If that happens it won’t matter what he or any Republicans say. People will see prices going up with their own eyes and because Republicans are in charge they will be blamed for it.

Very good piece overall. Keep up the good work.