Peron on the Potomac

We’ve seen this movie before – in Argentina

Last Friday, President Trump fired the head of the Bureau of Labor Statistics (BLS) just hours after the BLS released disappointing employment numbers. That’s a big deal. It’s also shocking for the world’s most important country and most important economy to do so. This isn’t normal. “Banana republic” was trending on Twitter, and no, that did not have anything to do with jeans.

Trump's firing of the BLS Commissioner came with the now-familiar accusation: the numbers were "rigged" and manipulated for political purposes. Never mind that statistical agencies have been historically insulated from politics precisely so they can provide accurate economic data, or that even Republican senators expressed concern about undermining the agency's integrity. When economic reality conflicts with political needs, Trump's solution is to shoot the messenger. Trump and his team have a certain ‘lol nihilism’ when it comes to the economy and it’s worth spelling out why this is such a problem. This isn’t a joke and there won’t be any mulligans once Trump has shanked his economic policy drive into the woods.

Whether Trump and his team know it or not, what they’re doing has been tried before. It’s what Juan Peron did in the 1940s that turned Argentina into a poster child for economic dysfunction. If you want to understand where Trump's attacks on our foundational economic institutions can lead, look to Argentina. Warning: the ending isn't pretty.

What Happened in Argentina, Briefly

Juan Peron came to power in Argentina in 1946 promising to wield political power to bend the economy to his will and to the benefit of his supporters. He was an economic nationalist who put up huge tariffs to choke off imports in an attempt to force manufacturing to locate in Argentina. He combined that with fiscal policy where taxes were way lower than spending and then added expansionary monetary policy to that (he essentially printed enormous amounts of money to fund higher government spending).

Much as Trump views the Fed now, Peron saw the judiciary as an institutional check on his control of the economy. So, he initiated trials against three Supreme Court justices and forced the fourth to resign for "thwarting the populist will." He took over the central bank because he didn’t respect their independence. He would always blame external forces for whatever ailed Argentina. It was always some foreigner who did something nefarious. His government became so quickly and so rampantly favoritist that it encouraged economic actors to spend more time rent-seeking and lobbying the government for favors than in producing more. He relentlessly attacked tellers of inconvenient truths. Manipulation of economic statistics would become routine under later Peronist governments. To give just one example, they consistently misreported their inflation data to the IMF in the context of loans and debt repayments. Actual inflation rates were often three times higher than what the government said it was.

All of this created a steady erosion of confidence in the Argentine economy. Regular people on the street paid the price. Prices soared. Investment from abroad was slowed. Growth was anemic. Reformers in various eras have tried to fix the mess, mostly notably under Carlos Menem in the 90s and now Milei. But the damage has been hard to undo. By one estimation, with the Peronist attacks on the economy, Argentina would have a standard of living today equal to New Zealand’s. Instead, it has a GDP per person that is 28% of New Zealand’s. In short, Peron -and the Peronists who followed him- have been a disaster for Argentina.

Trump’s Similarities to Peron

I am not saying that Trump is intentionally re-running the Argentine playbook (he’s not curious enough or knowledgeable enough about comparative political economy for that to be the case), but he’s doing many of the same things.

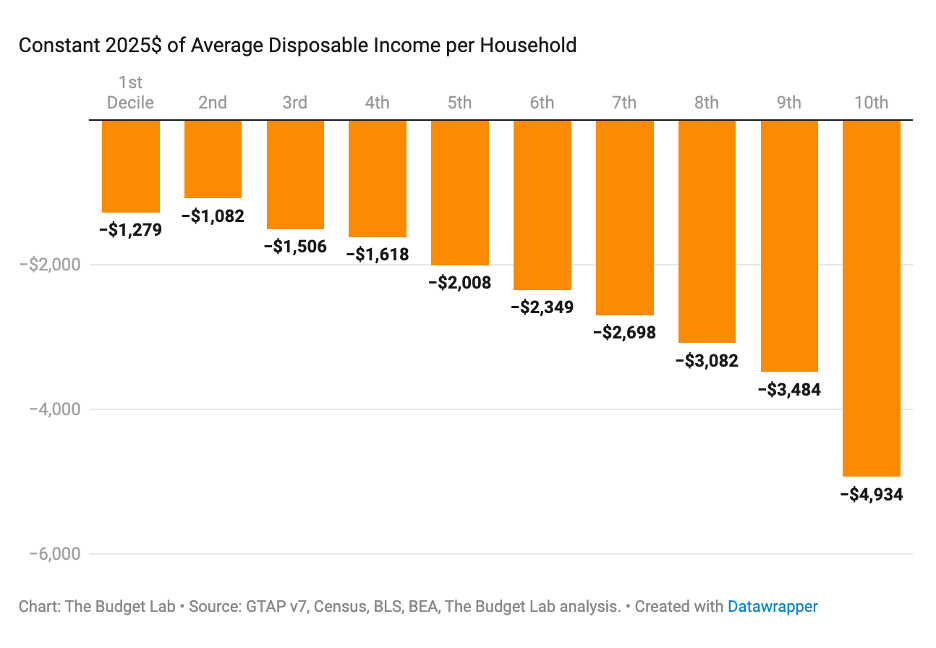

Like Peron, Trump is an economic nationalist. Tariffs are Trump’s signature economic policy, and they are already backfiring. Job growth the last three months has been abysmally slow (that’s what last Friday’s BLS report was about!). Inflation remains higher than the Fed’s target. Imported goods likelinens, oranges, olives, and appliances are seeing significant month-on-month price spikes, and we’re likely to get further evidence of that in the BLS’ next inflation report if the Trump administration doesn’t completely shred the BLS before then. Trump's tariffs are now costing the average American family more than $2,000 this year.

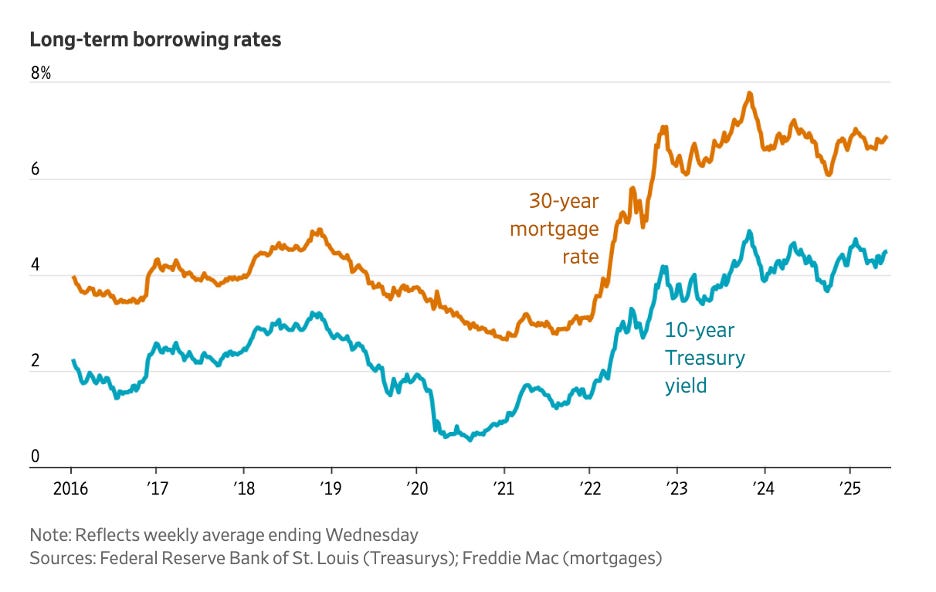

Trump’s largest domestic legislation, the Big Beautiful Bill is also fiscally reckless. It pushes deficits $3 trillion higher over ten years (and they were already approaching 2 trillion a year). Investors are starting to worry about lending us more money so now borrowing costs are rising. That impacts consumers when they need to borrow money for a house or a car. As you can see here, mortgage rates are strongly correlated with the 10-year T-note, i.e. how much it costs the government to borrow.

Meanwhile, Trump’s policies are weakening the dollar (it’s down roughly 10% since Trump took office), which reduces Americans’ purchasing power.

Trump has responded to all of this by attacking the Fed and the BLS, which further undermines credibility. International investors aren’t thinking ‘should I totally pull out of the U.S.?’ We’re too big and too dynamic of an economy for that. But they are thinking ‘should I reduce my exposure to the U.S. by 20%.’ The more they do that, the worse our economy performs, the fewer jobs there are, and the more expensive everything becomes.

If also deprives the President of a warning system if the economy is doing poorly. As two former chairs of the Council of Economic Advisers wrote, “Politicizing those federal statistics and questioning the integrity of those who produce them…is likely to come back to haunt the administration. It compromises the ability of policymakers in the executive branch, Congress and the Federal Reserve to properly analyze the state of the economy and develop the best policies to ensure prosperity.” Some of Trump’s saner moments on trade have been when he was reacting to the stock market tanking- that was a signal to him to change course. If he’s not getting good economic data because he’s stacked the statistics offices with yes men, how is he going to get that kind of a signal from our main economic indicators?

How the Story Ends

Here's how this story ends if we let it play out: economic instability, chronic inflation, and a steady slide from prosperity to dysfunction. Argentina's experience shows that once you start down the path of attacking independent institutions to serve short-term political needs, the damage compounds quickly and proves difficult to reverse. The institutional bulwarks that protect American economic stability (Fed independence, accurate statistics, the rule of law) didn't develop by accident. They developed because policy stability matters for business investment and for consumer confidence. Trump is taking a hammer to all of those institutional bulwarks.

Congress still has time to strengthen these institutions. They can amend the Federal Reserve Act to explicitly prohibit removal of Fed officials based on monetary policy decisions or create automatic triggers that would kick in if a President attempts to subvert Fed independence. They can also protect the integrity of statistical agencies that provide the economic data our entire economic system depends on by making it impossible to dismiss agency heads without Congressional approval. And they can act to restore Congressional primacy on trade policy. It is not too late. Or they can stand around and look the other way as Trump’s ‘lol nihilism’ burns through all the institutional girders that hold up our economy. It’s what Peron did, and it’s what Trump means to do. Does Congress, and by that I mean do Congressional Republicans, have the fortitude, integrity, and economic sensibility to stop him?

For Democrats, even though we are in the minority right now, we should be highlighting what a big deal this is now because, if Trump is able to undermine our country’s most important economic institutions, that is going to impede our ability to successfully govern in the future. It fritters away the dollar’s position as the undisputed global reserve currency, that cannot easily be wrested back. If government borrowing costs have gone through the roof, that limits our ability make strategic investment in infrastructure. If no one trusts us to be a good-faith trade partner, how do we be the economic leaders of the free world? If no one believes in Fed independence anymore, how do we keep inflation in check? If no one trusts the economic data that our central statistical agencies promulgate, how do businesses or citizens make sound financial decisions?

The choice for both parties is stark: we can preserve the institutional independence that makes our long-term economic prosperity possible or we can follow Argentina's path toward chronic instability and decline. Our country’s future, and our wallets, depend on how we answer this question.

-GW