Trump’s Trade War Hits the Nursery

They Want More Babies, With Fewer Car Seats

Now that the One Big Beautiful Bill has sadly passed and signed its way into law, President Trump has been able to return his attention (until the next shiny thing comes along), back to his favorite topic – tariffs! You may be thinking, did we not just have Liberation Day back in April, that almost crashed the stock market and sent the economy into a frenzy? We did. And he responded to the impacts with an Executive Order to push back the deadline that gave almost every country on earth at least a baseline of 10% tariffs by 90 days, and started the journey of 90 deals in 90 days. Spoiler alert, it did not happen. Now we are left with Liberation Day Part Two, and we are sporadically sending out trade letters to countries (with spelling and grammatical errors galore), via the President’s social media platform with a new deadline of August 1st, 2025. And don’t worry, there is a new Executive Order to announce the new deadline as well.

All of that information is a lot to keep track of, and the impacts of tariffs across industries and sectors are so vast, that reporting can often get muddled or at times buried. That's why I want to focus on one concrete impact: while we're experiencing this constant rollercoaster of on-again, off-again tariffs, families across the country are facing a harsh reality as tariffs drive up the cost of baby necessities.

Image Credit: Rachel Cohen Booth

Tariffs Are Raising the Cost of Baby Essentials

Tariffs on imports have made even basic baby items – from toys to strollers – more expensive. Many of these goods are imported and now face new duties, a cost ultimately passed on to parents.

Image Credit:John Shelton.

While trade wars can seem abstract, the effects on household essentials are very real. In particular, parents of infants are facing a surge in prices for everyday baby necessities. A new congressional analysis in June found that since Trump’s tariffs took effect, new parents are paying about 24% more for key baby items on average. The Joint Economic Committee (JEC) examined popular products and observed significant jumps in just over two months. For example, a common infant car seat that cost around $96 in early April now sells for about $139 (up $43), and staples like cribs, strollers, and high chairs have each climbed by $10–$20 apiece.

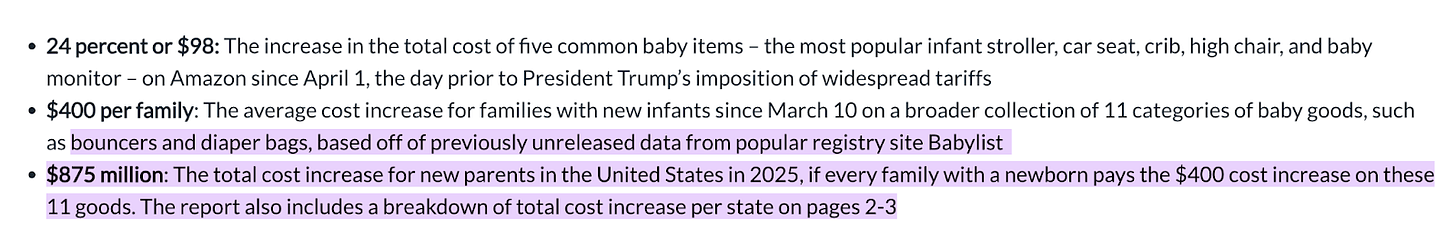

By the numbers, this tariff-driven “baby tax” adds up quickly:

Image Credit: The JEC

Across baby and parenting blogs, discussions regarding a global trade regime plan would typically never be discussed but as these tariff wars continue to rage on, we are seeing stories pop up with headlines just like this one: "90% of Baby Products Get Hit With Tariffs: What Parents Need to Know." When The Bump – a mainstream parenting publication – starts covering import duties alongside diaper recommendations, you know the impact has reached Main Street America.

According to the Juvenile Products Manufacturers Association, nearly 90% of core baby products will be impacted by tariffs, particularly those manufactured in China. These aren't luxury items – we're talking about safety-critical gear like car seats, cribs, strollers and high chairs. Popular brands like Doona, Nuna, UPPAbaby and Cybex have already raised prices by 20-25%, while others like Graco and Baby Jogger following suit by May.

Parents and Businesses Feel the Squeeze

Not only are families paying more, but the ripple effects of these tariffs are hitting small businesses that serve parents. Local baby gear boutiques and retailers operate on thin margins, and sudden import taxes have thrown them into turmoil. “We’re on a rollercoaster. One week we’re selling out of car seats to people panic-buying; the next, we can’t even get new inventory in,” says one baby store owner, describing the whiplash since tariffs were announced. Many of the products her shop sells simply aren’t manufactured domestically, so there’s no easy alternative supply. If foreign suppliers are stalled or the costs skyrocket, her shelves stay bare – and young families go without essential, safe products. “It’s not fearmongering. It’s real. I cannot get inventory,” she lamented, noting that if she can’t stock cribs or strollers to sell, her business may only have months left before it’s forced to shut down. This predicament isn’t unique: across the country, small retailers are warning that Trump’s volatile trade moves are jeopardizing their survival.

Small businesses selling baby goods find themselves squeezed between not wanting to gouge new parents and not being able to shoulder the tariff burden indefinitely. For many, the choice is between hiking prices (and potentially losing customers) or swallowing the costs (and risking closure). Either way, the outcome is bleak – families end up paying more or local shops go under, or both.

Not as Pro-Family of an Admin as They’re Claiming

The timing could not be worse. The added "baby tax" arrives on top of already steep challenges for young families – from soaring childcare costs to no guaranteed paid parental leave nationally.

Image Credit: Five First Years Fund

These longstanding issues have been cited as reasons many couples delay or decide against having children. From the parents' perspective, it certainly feels like an ironic one-two punch: the administration talks about pro-family ideals, even as an unpredictable tariff regime is directly undercutting family finances.

The hypocrisy is jarring as Vice President JD Vance has made his time as a Senator and campaign focus on family policy as his number one priority. In fact, his first public speech as VP noted how he wanted "More babies in America."

He even touted the idea of a 150% increase in the Child Tax Credit, “I’d love to see a child tax credit that’s $5,000 per child… President Trump has been on the record for a long time supporting a bigger child tax credit, and I think you want it to apply to all American families.”

Yet despite this pro-family rhetoric, what actually materialized was a modest increase of the Child Tax Credit in the Omnibus Budget Bill – a far cry from the ambitious $5,000 figure Vance championed. Meanwhile, his rhetoric about prioritizing families has notably diminished since taking office, even as tariffs continue to wreak havoc on young parents' budgets. The disconnect between campaign promises and policy reality highlights the administration's failure to deliver meaningful solutions to achieve the pro-birth agenda they so vocally promoted.

It is not pro-family to make the most expensive part of a person's life even more unaffordable. After all, if a car seat becomes too expensive or hard to find, some desperate families might cut corners with a substandard product – with potentially dangerous consequences. These stakes make it all the more critical that the issue gets the public attention it deserves.

Breaking Through the Noise

Amid the daily cacophony of tariff updates and breaking news, the human impact of these trade policies risks being lost in the noise. The tariff saga itself has been dizzying – an "ever-changing agenda" that even seasoned business owners struggle to follow. When every week brings a new twist, it's easy for coverage of specific impacts like pricier diapers and cribs to get buried beneath the political theater.

Breaking through requires putting a human face on the numbers. Personal stories – like the new mom hunting for secondhand toys online, or the family-owned shop on the brink due to supply woes – help audiences emotionally connect to abstract economics. Calling these price hikes a "baby tax" instantly makes the issue understandable and resonant. And concrete data points like "24% increase in baby prices in 2 months" or "$400 extra per family" give the public a clear sense of scale that validates parents' experiences.

In the end, winning the attention economy battle on this issue means reminding everyone of a basic truth: economic policy isn’t just about countries or companies – it’s about kids, cribs, and the quality of life in our own homes. Amid all the tweets and tariff schedules, that human angle must remain front and center. Only then will the plight of families grappling with pricier baby essentials get the recognition and response it urgently deserves.