Trump is Making the Dollar Weaker

And That’s Quietly Eroding Your Purchasing Power

When President Trump took office, the economy was booming and the value of the dollar was at a two-year high. Since then, the value of the U.S. dollar is down more than 10 percent, with President Trump’s policies being a major reason why.

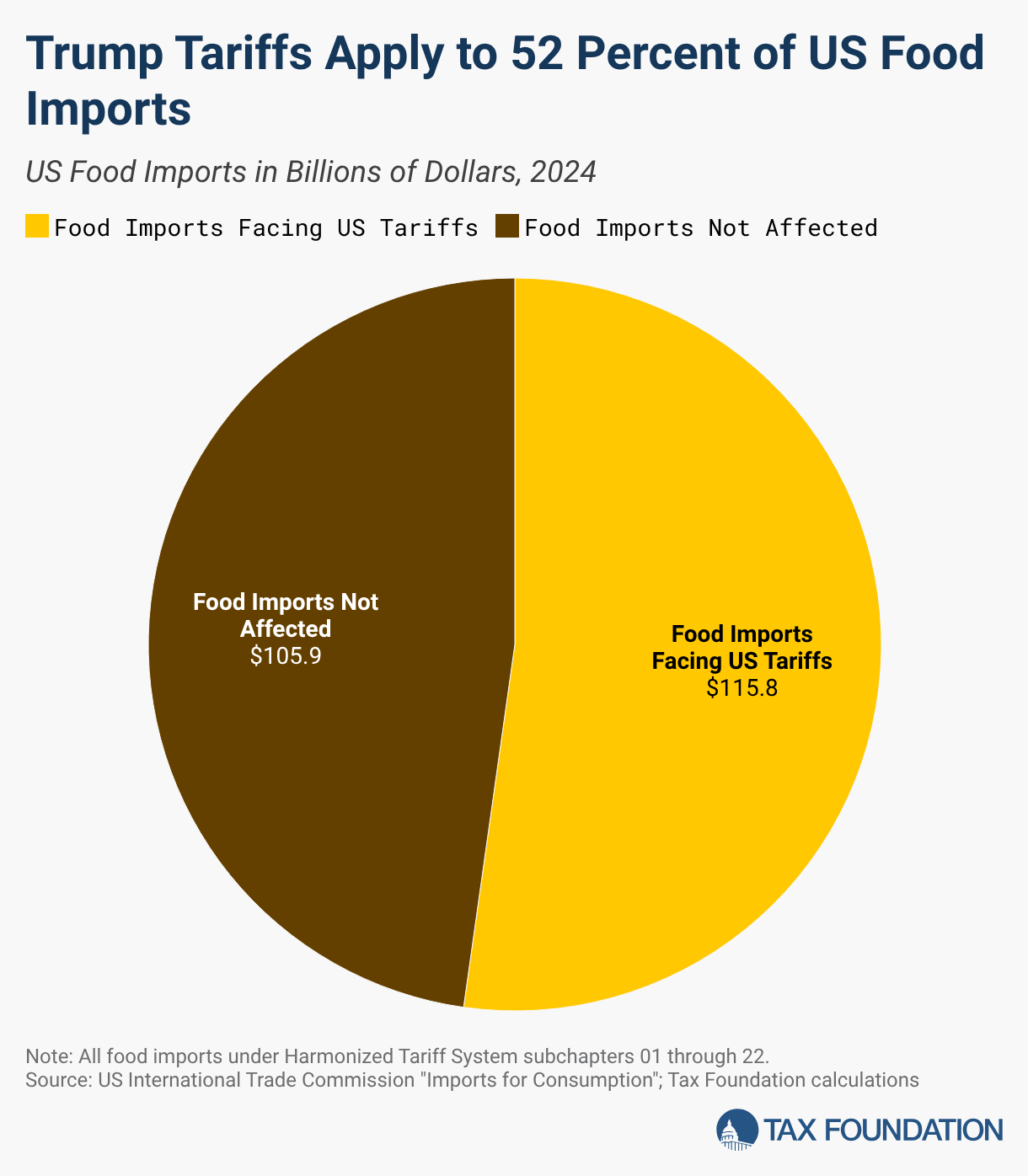

This has been widely under-appreciated by the public (which is understandable given just how much nonstop chaos swirls around this administration), but it is nevertheless weakening consumers’ purchasing power and slowing down job growth. On the consumer side, the strength of the dollar affects how much Americans need to pay for imported goods. When the dollar gets weaker, Americans have to pay more for their fruit, avocados, seafood, and a whole range of other products — and that’s on top of the tariffs the Trump administration has added to those items. In fact, over half of all grocery items (more than 100 billion dollars worth of food per year) now have tariffs on them.

You may not realize it, but the sinking dollar is an important contributing factor behind why checking out at the grocery store feels so expensive. The weakening dollar hits you just as hard when you need to buy furniture or clothes or anything else imported.

Likewise, the now-weaker dollar also makes it more expensive for businesses to import the inputs they need to make other products or provide services. So, the weaker dollar means that homebuilders have to pay more for lumber and steel, which drives up the cost of building new housing, which then translates into higher housing costs for renters and homebuyers. Something similar happens in energy. By driving up the costs of energy investment, the weaker dollar under Trump makes electricity more expensive over time. Those higher input costs also make it harder for businesses to hire more workers. This is especially true in manufacturing, which has been battered under the Trump administration. As the Wall Street Journal points out, the U.S. has lost manufacturing jobs every month since Trump’s ‘Liberation Day’ tariffs.

So how exactly is Trump causing this? He’s doing three main things that are undermining the dollar: tariffs, deficits, and attacking the Fed.

Trump’s Tariffs are Making the Dollar Weaker

Trump’s tariffs are undermining the dollar in two key ways. First, tariffs make American exports less competitive globally. When Trump slaps heavy tariffs on imports from other countries, those countries often retaliate with their own tariffs on American goods. That makes it harder for American companies to sell their products abroad. When foreign buyers purchase fewer American goods, they need fewer dollars to make those purchases, which reduces demand for the dollar and drives down its value. Trump thinks a weaker dollar helps American exporters, even calling it “great” recently. This was not a one-off comment. He has consistently argued for a weaker dollar including in a speech last July.

But the cost of that weaker dollar (higher prices for everything Americans import, more expensive housing and energy, reduced purchasing power for working families) far outweighs any export benefits. It’s a lose-lose policy driven by economic ignorance.

Second, and more importantly, the tariffs have shaken global confidence in America’s economic leadership. Investors around the world have traditionally viewed the dollar as a safe, stable store of value. But Trump’s erratic tariff policies (imposing them one day, rolling them back the next, threatening new ones constantly) has made America look unpredictable and unreliable. On top of reducing future growth, this is leading investors, on the margin, to rethink how much they want to have their savings in dollars rather than a less dollar-heavy portfolio of currencies. And, this is exactly what we have been seeing. Investors are buying more gold, euros, and other currencies relative to their dollar assets. Gold has hit record highs this year on continued buying by central banks worried about devaluation of their dollar assets. Again, that reduces demand for the dollar which reduces its value.

Traditionally, when markets get volatile, the dollar strengthens as investors flee to safety. But when the dollar fell during the market chaos after Trump’s ‘Liberation Day’ tariff announcement, it signaled something had fundamentally broken; global investors no longer saw the U.S. as the safest place for their money.

Higher Deficits Also Weaken the Dollar

Trump’s massive tax cuts are also driving down the dollar by flooding the market with government debt that investors increasingly don’t want to buy. In July, Trump signed the “One Big Beautiful Bill“ into law, which made his 2017 tax cuts permanent and added even more tax breaks on top. The law will add $3.4 trillion to the federal budget deficit over the next decade. That’s an enormous amount of new borrowing. Our fiscal situation is so bad that last May Moody’s downgraded the United States credit rating.

To finance these deficits, the Treasury Department has to sell trillions of dollars in bonds to investors. But here’s the problem: when you’re flooding the market with debt while simultaneously making America look like an unreliable place to invest, buyers demand better terms. And those buyers are increasingly skeptical.

Global investors are worried that the U.S. government will inflate away the debt so they sell dollars and buy other currencies instead. The bigger the deficits get, the more pronounced this effect becomes. In a way, Trump and his Congressional Republican allies are racking up a huge credit card bill that middle-aged and younger voters will have to deal with later. In addition to that longer-term fiscal problem, there are already consequences to this right now and one of them (in addition to higher interest payments on the debt) is a weaker dollar that is making everyday Americans pay more for many of the things they need to buy.

Attacking the Fed

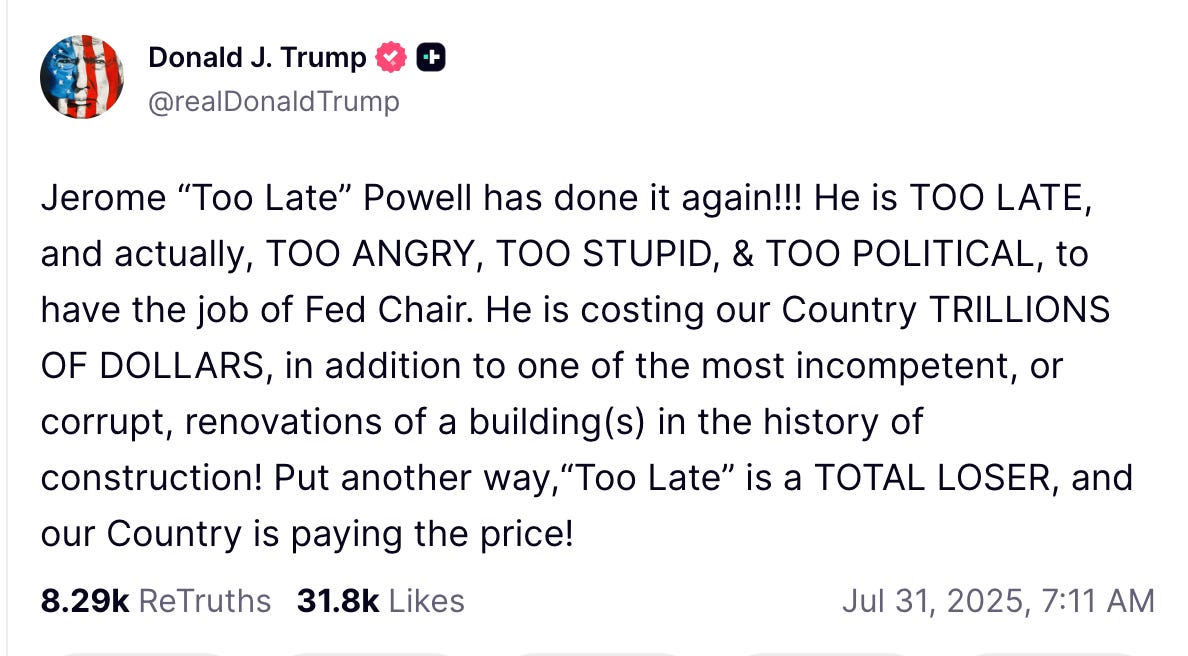

The third way Trump is undermining the dollar is by attacking Jay Powell and the Federal Reserve — the very institution responsible for maintaining confidence in American currency. Trump has spent months publicly berating Powell for not cutting interest rates fast enough.

He also sent an open letter to Powell demanding the Fed lower rates “by a lot”, he threatened to fire Powell, and his Department of Justice launched a bogus criminal investigation into Powell over his congressional testimony.

This matters because the Federal Reserve’s independence is what gives the dollar its credibility. When investors around the world hold dollars, they’re trusting that the Fed will make decisions based on economic data and long-term stability, not what’s politically convenient for whoever happens to be president. That independence is one of the reasons why the dollar has been the world’s reserve currency for decades. By openly trying to bully the Fed into submission, Trump is destroying that trust. Global investors are watching an American president try to turn the central bank into a political tool, and they’re responding rationally: by reducing their exposure to dollars.

Congressional Republicans Can Stop This Anytime They Like

Congressional Republicans have the power to stop this. They could push back on Trump’s erratic tariff policies. They could refuse to pass deficit-financed tax cuts that add trillions to the debt. They could defend the Fed’s independence and make clear that attempts to politicize monetary policy are unacceptable. But they aren’t. A few have expressed private concerns, but that changes absolutely nothing. They own this as much as President Trump does.

Every time you check out at the grocery store, every time a construction project gets delayed because materials cost too much, every time electricity bills creep higher, you’re experiencing the consequences of a weaker dollar that Trump’s policies created and congressional Republicans enabled.

The midterms present an opportunity to fix this. We can elect a Democratic Congress that takes fiscal responsibility seriously, that understands tariffs are taxes on American consumers, and that will defend the independence of institutions like the Federal Reserve. Note though that this is a test for Democrats too. We cannot criticize Trump for this mess of his and then turn around and elect representatives who defend tariffs, treat huge deficit spending as unproblematic, and won’t defend Federal Reserve independence.

-GW

I wonder what the benefit of a weak dollar could be? Any idea why China has always artificially kept the value of their currency extremely low? There are domestic sources of lumber and steel, why would home builders be in the habit of buying imported products?