Trump Goes Full Slopulism

Trump’s new affordability pitch recycles bad ideas and delivers nothing

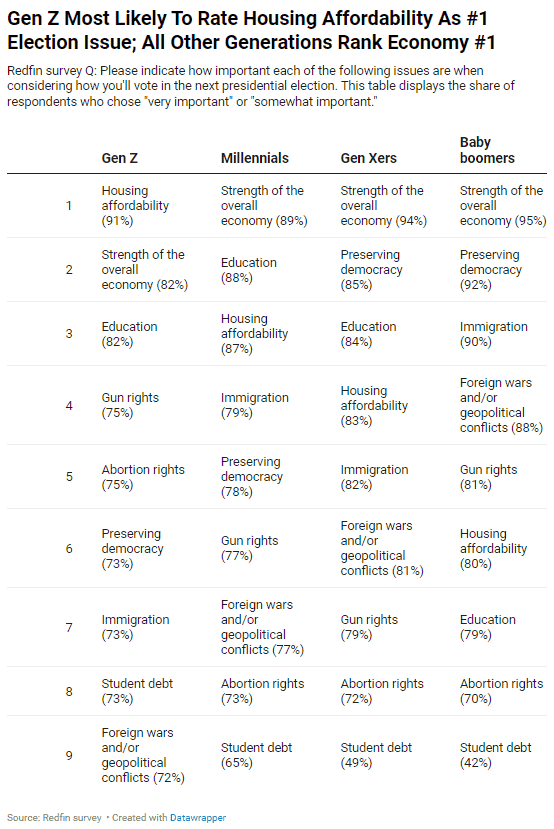

In the past few weeks, Trump has launched a flurry of eye-catching initiatives aimed at showing he’s “doing something” about the economy. He’s proposed federal caps to make borrowing cheaper for consumers – most notably, announcing a one-year cap on credit card interest rates at 10%. At the same time, Trump has pivoted to housing affordability, rolling out measures that take a swing at various perceived culprits His most recent move comes from the White House floating an antitrust probe into homebuilders is the latest in a series of populist-sounding gestures that will do absolutely nothing to bring down the cost of housing. The fundamental problem is not that DR Horton and Lennar are colluding to restrict supply, it’s that local zoning codes, permitting delays, environmental review timelines, and labor shortages make it extraordinarily difficult and expensive to build. Trump himself has even admitted that he does not want to see the prices of homes fall. That’s right! He has said the quiet part out loud. While housing affordability was among the top issues for voters in the 2024 election, it was also the number one issue for Gen Z, which makes sense why after a year of Trump’s policies, the groups who swung to him the hardest are the quickest to jump ship.

Image Credit: Redfin

Yet rather than push for the kinds of regulatory reforms that would actually unlock production, his administration is teasing an investigation that, even if it moves forward, would take years to litigate and wouldn’t add a single unit of housing.

It’s the same playbook we’ve seen on grocery prices and energy costs: find a villain, announce you’re going after them, and hope voters don’t notice that you didn’t do a thing to fix the structural barriers. If the administration were serious about affordability, it would be leaning on Congress to tie federal funding to zoning reform, streamline NEPA review for residential construction, or expand programs that reduce the cost of building — not doing a splashy DOJ probe that lets the president look tough while accomplishing nothing.

This slopulist blitz extends even further. On social media and at rallies, Trump has floated out-of-the-box ideas like extending the standard 30-year mortgage to 50 years for first-time homebuyers – a move he touted as a potential “game changer” to reduce monthly payments. (Never mind that housing experts quickly warned a 50-year loan would mostly just saddle young buyers with decades of extra interest and slower equity build-up. In fact, within weeks the idea was quietly shelved amid criticism.

At first glance, these proposals all sound appealing in populist terms. Who wouldn’t want lower interest on their credit cards, cheaper prices at the register, and more available houses for sale? Politically, it’s a ready-made narrative for Trump: he casts himself as taking on banks, corporate landlords, and powerful industry groups on behalf of “the people.” Each idea targets a convenient villain – greedy credit card companies, Wall Street mega-landlords, or alleged homebuilder monopolies – allowing Trump to claim he’s battling those who are “ripping off” ordinary Americans. It’s a classic populist playbook, heavy on rhetoric about fighting elites and fixing rigged systems. And to be fair, populism thrives on identifying real frustrations. Sky-high credit card APRs are squeezing young borrowers, housing is out of reach for many families. The problem, however, is that Trump’s quick-fix solutions often don’t hold up under scrutiny. Taken as a whole, this agenda is more smoke and mirrors – a series of headline-grabbing stunts that sound promising but won’t actually deliver meaningful relief.

Horseshoe Politics

Here’s the thing that makes this whole charade even more frustrating: none of it is new. These ideas aren’t even originally Trump’s. As Scott Lincicome recently documented, nearly every “affordability” proposal Trump has rolled out in recent weeks was first championed by the populist left — the very people Trump accuses of being on the “radical left.”

The credit card interest rate cap at 10%? That was a Bernie Sanders and Alexandria Ocasio-Cortez proposal. Trump’s executive order targeting institutional investors buying single-family homes? Democrats like Sen. Jeff Merkley and Sens. Elizabeth Warren and Sherrod Brown pushed similar legislation years earlier. The push to leverage Fannie Mae and Freddie Mac to manipulate mortgage markets? Progressive Democrats have advocated for exactly this kind of GSE intervention for years. Even Trump’s investigation into meatpackers for alleged price-fixing echoes Biden’s 2022 State of the Union accusations of meatpacker “profiteering” and Warren’s broader “greedflation” narrative.

And this is the crucial point: these ideas didn’t work when Democrats proposed them either. The left’s version of slopulism has its own long track record of sounding great in a press release and falling apart on contact with economic reality.

The real solutions to affordability — reforming local zoning, streamlining permitting, investing in housing supply, removing trade barriers on construction materials and food — are complicated, slow, and boring. They don’t make for good rally lines. They offend entrenched interests on both sides of the aisle. But they’re the only things that actually work.

In the end, sound-bite populism is no substitute for sound policy. Voters may applaud a tough-sounding proposal initially, but they also notice when their rent is still high, their credit card bill hasn’t changed, or that starter home remains unaffordable. Just because he donned a McDonald’s workers uniform once during his campaign, does not mean he is a man for the working class.