While Washington finally ended its record shutdown, the cost-of-living battle is far from over. The past two weeks brought a mix of progress and setbacks: bipartisan permitting reform advanced, Massachusetts moved to cut energy costs, and the administration suspended food tariffs—but looming threats like expiring health subsidies and misguided housing proposals remind us that affordability gains remain fragile. Here’s your rundown of recent developments affecting Americans’ cost of living:

New Pro–CoL Developments:

Congress Advances Modernizing “Permitting Reform” to Lower Building Costs

What happened: A bipartisan effort to cut construction red tape is advancing. On Nov. 20, the House Natural Resources Committee approved the ePermit Act, which would create an all-digital federal permitting system for projects from housing to energy infrastructure. By modernizing the paper-heavy process (including environmental reviews), the bill aims to speed approvals and reduce years-long delays.

Why it matters: Construction delays drive up costs that hit consumers through higher home prices and expensive infrastructure projects. Streamlining approvals could increase housing supply and lower infrastructure costs long-term. “It takes too long to build in America,” said Rep. Johnson—faster permitting can “unlock development” and eventually reduce everything from rent to electricity costs. The bill’s bipartisan support signals rare consensus that housing and infrastructure affordability can improve by cutting government red tape, a practical reform with lasting benefits.

Massachusetts Advances Energy Affordability Bill

What happened: Massachusetts lawmakers unanimously approved legislation (H.4744) that prioritizes lower utility bills over some climate goals. The bill makes the state’s 2030 emissions target advisory (not binding), slashes energy efficiency program funding, restores incentives for natural gas heating, and requires proof that climate measures won’t impose “unreasonable costs” on residents or businesses. Sponsors estimate $7.61 billion in ratepayer savings over 10 years.

Why it matters: Massachusetts has some of the nation’s highest electricity rates, making energy costs a political flashpoint. If passed, the bill would deliver immediate relief—slowing the growth of surcharges and keeping monthly bills from rising as fast. That’s a direct win for household budgets and businesses. But critics warn that cutting clean energy investments could backfire with higher costs long-term and missed climate targets.

U.S. Suspends Tariffs on Beef and Food Imports to Ease Prices

What happened: In a surprise policy reversal, the Trump administration announced that it would suspend tariffs on several categories of imported beef, lamb, and processed food products from Australia, New Zealand, and select EU countries through mid-2026. The move comes amid rising consumer food costs and follows pressure from both food industry groups and bipartisan lawmakers to lower grocery prices before the holiday season. The suspension applies to both fresh and frozen beef and certain dairy-based goods, removing tariffs that ranged from 10% to 25%.

Why it matters: Meat and dairy are major drivers of grocery inflation — with beef prices up 9.3% year-over-year in October. By cutting import costs, the administration aims to boost domestic supply and soften price spikes just as holiday demand peaks. USDA analysts project the tariff rollback could shave up to 6% off retail beef prices by early 2026, especially for ground beef and imported cuts used in restaurants and institutional food. While the move drew criticism from U.S. cattle producers, it’s being framed as a targeted anti-inflation measure to deliver quick relief to households facing record grocery bills.

New Anti–CoL Developments:

ACA Subsidy Cliff Looms After Shutdown Deal

The good news: Congress ended the federal shutdown on November 12. The bad news: the stopgap bill didn’t extend enhanced ACA premium subsidies expiring December 31. Senate Republicans promised a vote next month, but House leaders haven’t committed.

Why it matters: Without action, 22 million Americans face doubled insurance premiums. California’s rates would jump 97%, potentially pricing out 400,000 residents. Millions of low- and middle-income families nationwide risk losing coverage or paying far more—a major cost-of-living hit in 2026. Insurers are already warning of rate hikes, and open enrollment is happening now without guarantees.

Trump’s “50-Year Mortgage” Would Trap Buyers in Lifelong Debt

What happened: Donald Trump proposed allowing 50-year mortgages as a solution to high housing costs, claiming longer loan terms would lower monthly payments for young homebuyers. The idea has drawn widespread criticism from economists and housing experts as a misguided gimmick that would trap Americans in debt for life without addressing actual home prices.

Why it matters: As I mentioned in a recent piece for Home of the Brave, monthly payments look lower, 50-year mortgages are a financial trap. A couple borrowing $360,000 would pay $235,428 over 10 years but only reduce their loan by $14,436—building just 6% equity while 94% goes to interest. They’d pay nearly double the home’s cost over five decades and still owe payments into their 70s. The real problem is housing supply: years of under-building and restrictive zoning have left the U.S. with far too few homes, driving prices 60% above pre-2020 levels. Demand-side gimmicks like ultra-long mortgages just enrich banks without building a single house. Experts across the political spectrum agree: we need to build more homes, not stretch debt across generations.

Trump’s $2,000 “Tariff Dividend” Check

What happened: Trump has proposed sending Americans $2,000 “tariff dividend” checks, funded by revenue from his import tariffs, possibly arriving mid-2026. No stimulus checks have been approved by Congress, and the IRS confirms no payments are scheduled. Meanwhile, scammers are exploiting the confusion with fake payment notifications.

Why it matters: This proposal is fiscally irresponsible and likely inflationary. According to the nonpartisan Committee for a Responsible Federal Budget, Trump’s plan would cost double what the U.S. expects to collect in new tariff revenue—meaning it would either blow up the deficit or require massive cuts elsewhere. Even if Congress approved it (which hasn’t happened), sending checks while simultaneously raising consumer prices through tariffs is economic whiplash: tariffs make everything more expensive, then the government sends a one-time payment that doesn’t cover the ongoing cost increases.

Win of the Week!

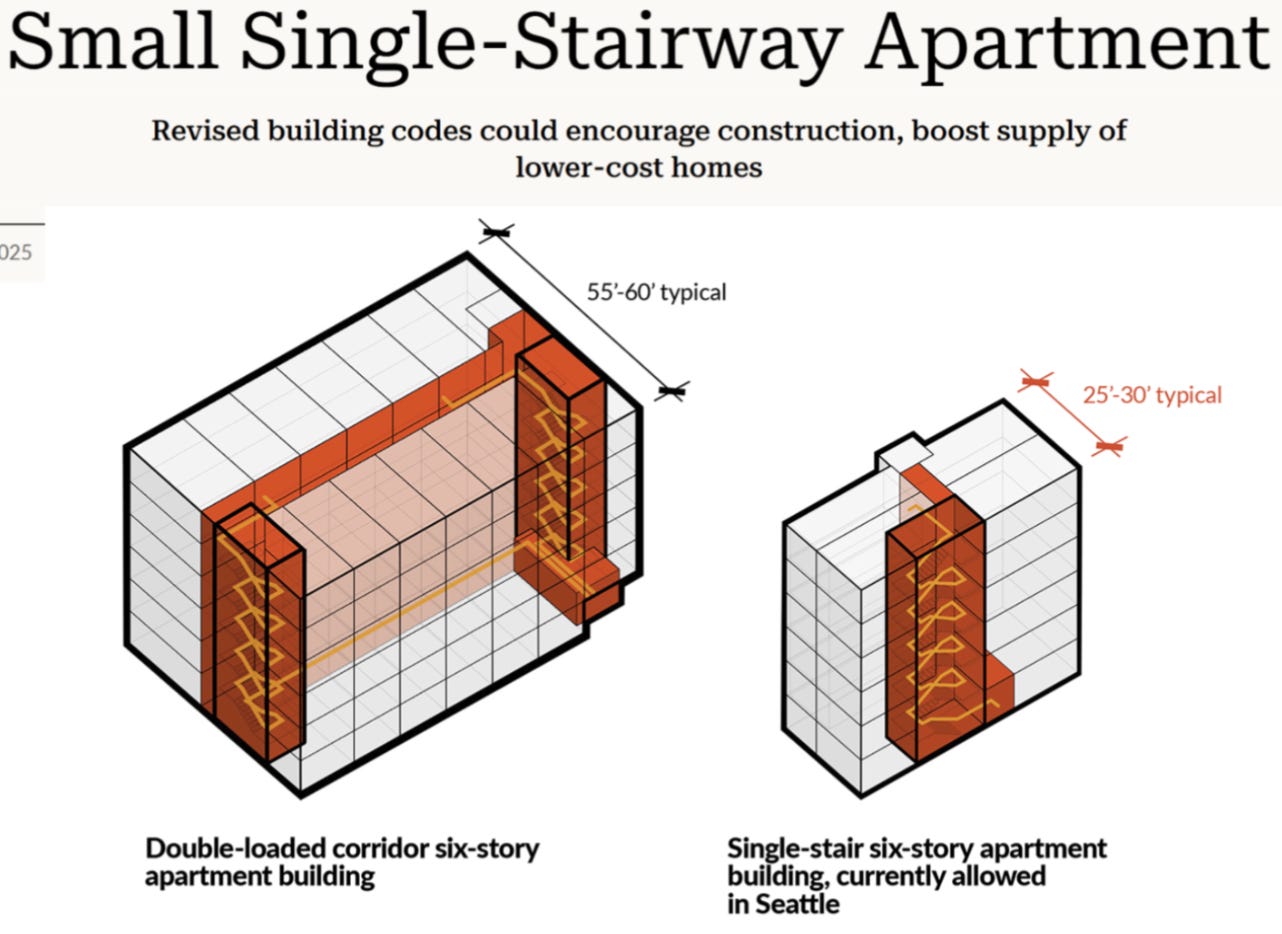

Our win of the week is Culver City, California approving single-stair reform, becoming the first California city to legalize mid-rise apartments built around a single staircase instead of the traditional two. This seemingly small change could unlock a wave of urban housing construction on smaller lots that are currently too cramped for conventional apartment buildings. Single-stair design allows for more units, bigger floor plans, better natural light with windows on multiple sides, and most importantly, makes it economically viable to build modest-scale apartments in transit-rich neighborhoods—exactly the kind of housing California desperately needs.

While fire safety concerns have historically blocked this approach despite strong safety records in Seattle and New York, Culver City’s unanimous approval (complete with enhanced fire prevention measures) gives the state a crucial test case for proving that European and global building standards can work here too.

That’s all for now! See you in two weeks!