I hope everyone had a great long weekend! Recently, the House passed a huge housing bill with a near-unanimous vote, egg prices keep falling, and the jobs report beat expectations (though the fine print is… less exciting). On the other side, tariff costs are finally hitting consumers, companies are pushing through a fresh round of price hikes, and Massachusetts is flirting with the strictest rent control in the country.

New Pro–CoL Developments:

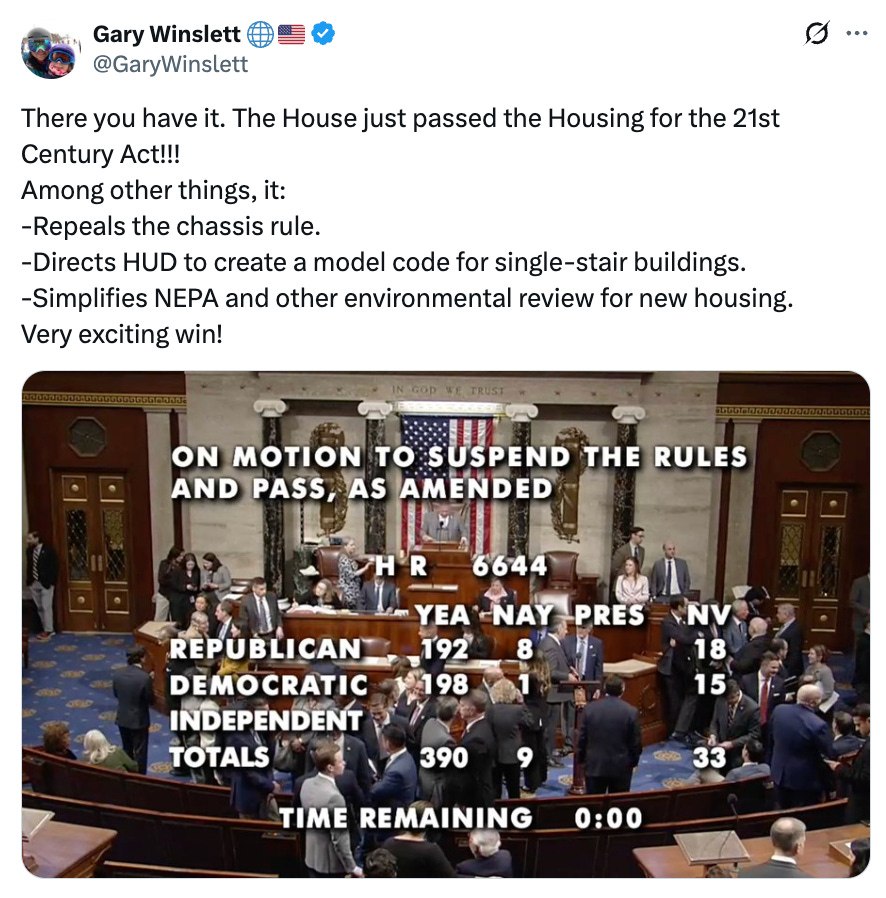

The Housing for the 21st Century Act was passed!

What happened: The House passed the “Housing for the 21st Century Act” by a vote of 390-9. The legislation reforms zoning, reduces federal barriers to construction, updates definitions for manufactured and modular housing to encourage factory-built homes, makes it easier to convert vacant offices into apartments, and eases lending for home repairs. A companion bill with bipartisan support passed the Senate previously.

Why it matters: This is the most significant housing affordability legislation to advance through Congress in over a decade. The overwhelming bipartisan vote (390-9) signals genuine political will on housing supply — a rarity. The bill tackles the root cause of the affordability crisis (not enough homes being built) rather than just subsidizing demand. Key elements like office-to-apartment conversions and modular housing could meaningfully accelerate supply in constrained markets. The two chambers still need to reconcile their versions, but momentum is strong.

Egg Prices Fell 7% in a Single Month, Down 34% from Peak

What happened: Egg prices dropped another 7% from December to January. USDA projects a further 22.2% decline over 2026 as avian flu pressures ease and production recovers.

Why it matters: This is mostly a supply recovery story, not a policy win—but the political economy matters. Eggs became the most visceral symbol of inflation frustration. Their return to normalcy removes a powerful talking point and, more importantly, provides real relief on a staple that lower-income families spend a disproportionate share of their grocery budget on. USDA projects overall grocery prices rising just 1.7% in 2026, below the 20-year average, with eggs and dairy actually deflating.

What happened: The economy added 130,000 jobs in January (172,000 private sector, minus 42,000 government), more than double the 68,000 projected. Unemployment ticked down to 4.3%. Private sector weekly earnings rose 0.7% in the month. Prime-age labor force participation hit its highest level since 2001.

Why it matters: The top-line number is genuinely good for affordability—more people working and earning more is the most direct path to household financial health. But the fine print tells a more complicated story. The annual benchmark revision revealed the economy added only 181,000 jobs in all of 2025—not the 584,000 previously reported. That’s an 862,000-job downward revision. Health care drove 123,500 of January’s gains; without it, the report is mediocre. Manufacturing has lost jobs every month since March 2024. And ADP’s private payroll data showed only 22,000 jobs added—a stark divergence from BLS. EY-Parthenon’s Greg Daco calls this a “jobless expansion” where wage growth is softening, giving employers the upper hand and squeezing household purchasing power.

Columbus Turns Church Parking Lots Into Housing

What happened: Columbus City Council voted 9-0 to create the “Yes in God’s Backyard” pilot program, fast-tracking housing on land owned by churches, schools, and nonprofits. About 60 churches have expressed interest, and the legislation could unlock over 1,000 parcels. Participating organizations get expedited permitting and zoning approvals in exchange for including affordable units.

Why it matters: Columbus has fewer affordable units per extremely low-income household than NYC or San Francisco — so the need is real. The model is smart: no new spending, no new land acquisition, just removing barriers for institutions that already have the land and want to help. California, Florida, New York, and now Virginia have all moved on similar legislation, and there’s a federal YIGBY Act in the Senate. It’s supply-side housing policy at its most practical.

New Anti–CoL Developments:

Tariff Pass-Through to Consumers Is Accelerating

What happened: Despite food exemptions and trade deals, the average effective tariff rate remains at 9.9%—the highest since 1946. The Tax Foundation calculates tariffs amount to a $1,300-$1,500 annual tax increase per household. Businesses absorbed roughly 80% of tariff costs in 2025, but JPMorgan projects that ratio could flip as pre-tariff inventories run out. Laundry equipment and appliances jumped 2.6% in a single month. Amazon CEO Andy Jassy publicly acknowledged that tariff costs are hitting consumers.

Why it matters: The tariff story is shifting from “businesses are eating the cost” to “businesses can’t eat the cost anymore.” Morningstar projects durables prices to rise a cumulative 4.5% and nondurables 5.6% over 2025-27. The political dynamic is interesting: Trump rolled back food tariffs on 200+ products in November after the midterm election shellacking, and analysts at Oxford Economics predict he’ll broaden exemptions further as 2026 midterms approach. The Supreme Court ruling on IEEPA tariff authority could upend the entire framework—J.P. Morgan estimates IEEPA measures account for 61% of the tariff increase. But even if IEEPA tariffs are struck down, alternative legal pathways exist. For household budgets, the direction is clear: more cost pass-through is coming in 2026, not less.

Massachusetts Moves Toward Rent Control

What happened: Boston Mayor Michelle Wu announced she’ll vote yes on a ballot question that would cap rent increases statewide at CPI or 5%, whichever is lower — which would make it the most restrictive rent control law in the nation. The Boston City Council already voted 9-3 in support. The measure exempts owner-occupied buildings with four or fewer units and new construction for its first 10 years. Massachusetts abolished rent control in 1994; this would reverse that. Real estate groups have promised up to $30 million to fight it.

Why it matters: Even Gov. Healey opposes this, arguing Massachusetts needs to build more housing, not cap rents. She’s right. A January 2026 report found 102 developments totaling just under 7,000 units are underway thanks to the state’s MBTA Communities zoning reform — proof that supply-side policy works. Rent control would undercut that momentum by reducing developer returns, discouraging new construction, and lowering vacancy rates further. Boston itself has already undershot its own modest housing production goals (11,804 units permitted over 2022-25 vs. a 13,000 target). Capping the symptom doesn’t fix the disease — and in housing, the evidence is overwhelming that it makes the disease worse.

Win of the Week!

Image Credit: X

Win of the week goes to the Housing for the 21st Century Act and the 390 House members who voted for it. In a Congress that can barely agree on keeping the lights on, getting a near-unanimous vote on substantive housing supply legislation is remarkable. The bill isn't perfect and it won't solve the crisis alone (as Rep. Waters correctly noted, unfunded policy reforms only go so far). But the combination of zoning reform, modular housing updates, office-to-residential conversions, and community banking provisions represents exactly the kind of "build more, lower costs" policy package that can make a real difference over time. Now it needs to get through conference, get funded, and get signed. The hard part is still ahead.