While some progress emerged on housing and infrastructure reform, the cost-of-living battle continues to intensify heading into 2026. The past two weeks brought encouraging bipartisan momentum on housing supply and permitting—including the Housing for 21st Century Act’s overwhelming committee vote and the CERTAIN Act’s introduction—but these gains sometimes get overshadowed by mounting pressures: holiday tariffs driving up prices on toys and consumer goods, rural housing markets overheating, and a weakening job market with rising unemployment. Here’s your rundown of recent developments affecting Americans’ cost of living:

New Pro–CoL Developments:

House Financial Services Committee advances the “Housing for the 21st Century Act” (markup passed 50–1).

What happened: HFSC moved a bipartisan housing supply package forward in committee on an overwhelming vote (50–1), teeing it up for next steps in the House process.

Why it matters: A real affordability lever is housing supply—and bills that reduce friction to build can lower long-run rent and home-price pressure. Even before enactment, big bipartisan votes signal momentum that can shape what lenders, builders, and cities expect (and plan for) in 2026.

Florida local adoption of “Yes in God’s Backyard” (YIGBY) begins (example: St. Petersburg action).

What happened: Florida’s SB 1730 framework lets local governments approve affordable housing on qualifying religious-institution land even if zoning would otherwise block it; St. Pete moved to adopt the option locally (reported as a first mover).

Why it matters: This expands the menu of “easy-to-site” land in built-out areas, potentially adding units faster than greenfield development. If other cities follow, it can modestly ease rent pressure—especially where faith-owned parcels are well-located near jobs and transit.

Virginia: Governor-elect Spanberger rolls out an affordability agenda spanning housing, health, and energy.

What happened: Spanberger previewed a state legislative agenda aimed at lowering costs—touching housing zoning/reforms, ACA premium help, and utility efficiency measures for low-income households.

Why it matters: States can move faster than Congress on zoning, utility rules, and consumer protections that directly change monthly bills. This also signals that affordability is becoming the organizing theme for 2026 state policy fights, which can drive more near-term interventions.

Senate Democrats launch a “cost-cutting” affordability initiative for 2026.

What happened: Senate Dem leadership publicly launched a lower-costs initiative—framing priorities around household expenses and explicitly tying part of the affordability squeeze to tariffs and other economic decisions.

Why it matters: Even without immediate passage, party initiatives shape what gets hearings, messaging, and coalition work—often determining which ideas become real bills. It also sets up clearer contrasts on tools like housing supply, energy costs, and trade policy that affect consumer prices.

Bipartisan CERTAIN Act introduced to accelerate federal energy and infrastructure permitting (Peters et al.).

What happened: On December 19, Rep. Scott Peters and a bipartisan group of House members released a discussion draft of the Create Expedited Reviews to Transform American Infrastructure Now (CERTAIN) Act, aimed at reforming the federal permitting process. The bill would impose clear timelines and deadlines on environmental reviews, protect lawfully issued permits from political interference, improve interagency coordination, and strengthen agency accountability to speed up energy and infrastructure projects.

Why it matters: Slow and uncertain permitting has delayed energy projects and contributed to higher electricity and energy costs for households. By accelerating grid, generation, and infrastructure build-out across all energy types, the CERTAIN Act could help lower utility bills, stabilize energy prices, and reduce cost-of-living pressures, while also creating jobs and improving long-term affordability.

New Anti–CoL Developments:

Holiday-season tariff impacts: higher prices and reduced selection in consumer categories (toys/decor/electronics-like goods).

What happened: Multiple reports describe tariffs raising import costs ahead of the holidays, pushing price pressure (or product mix changes) in tariff-exposed categories; one high-visibility example is the artificial Christmas tree market getting more expensive due to China-linked import exposure.

Why it matters Tariff-driven price bumps hit households most when budgets are already strained—right before holiday spending peaks—and can show up as either higher shelf prices or fewer low-cost options. Because these goods are widely purchased, even small increases can feel like “everything got pricier,” worsening consumer sentiment and perceived affordability.

Further:

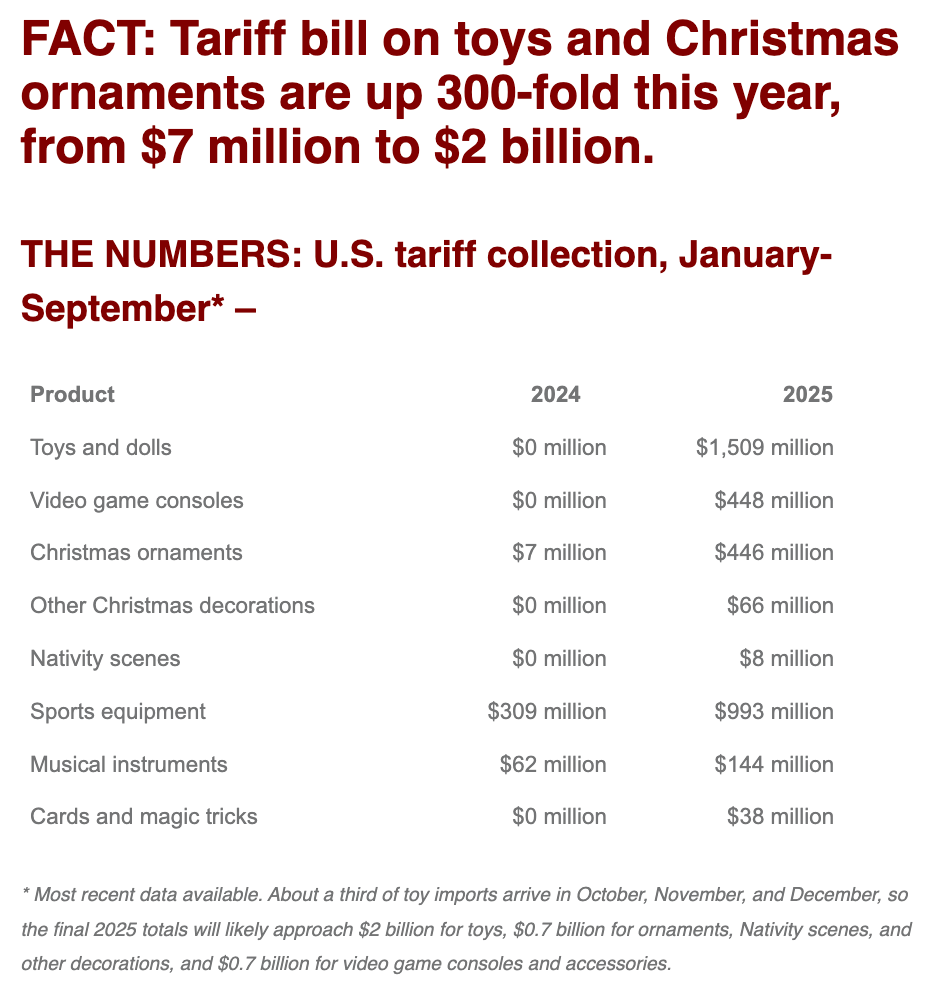

Image Credit: Ed Gresserhttps://www.progressivepolicy.org/

New tariff collections on common holiday goods surged in 2025 compared with 2024. From January–September alone, the U.S. collected $1.5 billion in tariffs on toys and dolls (up from $0), $448 million on video game consoles, $446 million on Christmas ornaments, and nearly $1 billion on sports equipment, with final 2025 totals expected to climb even higher as most toy imports arrive in Q4.

Rural housing prices surging faster than urban markets

What Happened: Home prices rising sharply in many rural counties. Some rural areas saw much stronger price growth than big cities, driven by migration and remote work demand.

Why it matters: While rural areas are often seen as more affordable, rapid price increases erode that advantage — especially for local residents with stagnant wages or fixed incomes. It also suggests affordability pressures aren’t confined to coastal or urban markets.

Layoffs and Unemployment Worsen:

What Happened: The job market has weakened on some fronts. The U.S. unemployment rate jumped to 4.6% in November, the highest in over four years (though part of that rise was due to data distortions from the temporary government shutdown). At the same time, companies have continued to announce layoffs. For example, consulting firm McKinsey revealed plans to cut about 10% of its workforce (thousands of jobs) over the next 18–24 months due to flatlining revenue.

Why It Matters: A rising unemployment rate and corporate downsizing mean more Americans are losing paychecks. Job losses or fear of layoffs make it harder for families to afford their expenses and can lead to reduced consumer spending overall. When people are out of work (or insecure in their jobs), they often must tighten budgets, and they may fall behind on bills, rent, or debt payments. Moreover, if layoffs spread, workers have less leverage to seek higher wages, further undermining household income growth at a time of elevated living costs. A lot of this can be contributed to the ongoing elevated economic uncertainty we are facing.

Win of the Week!

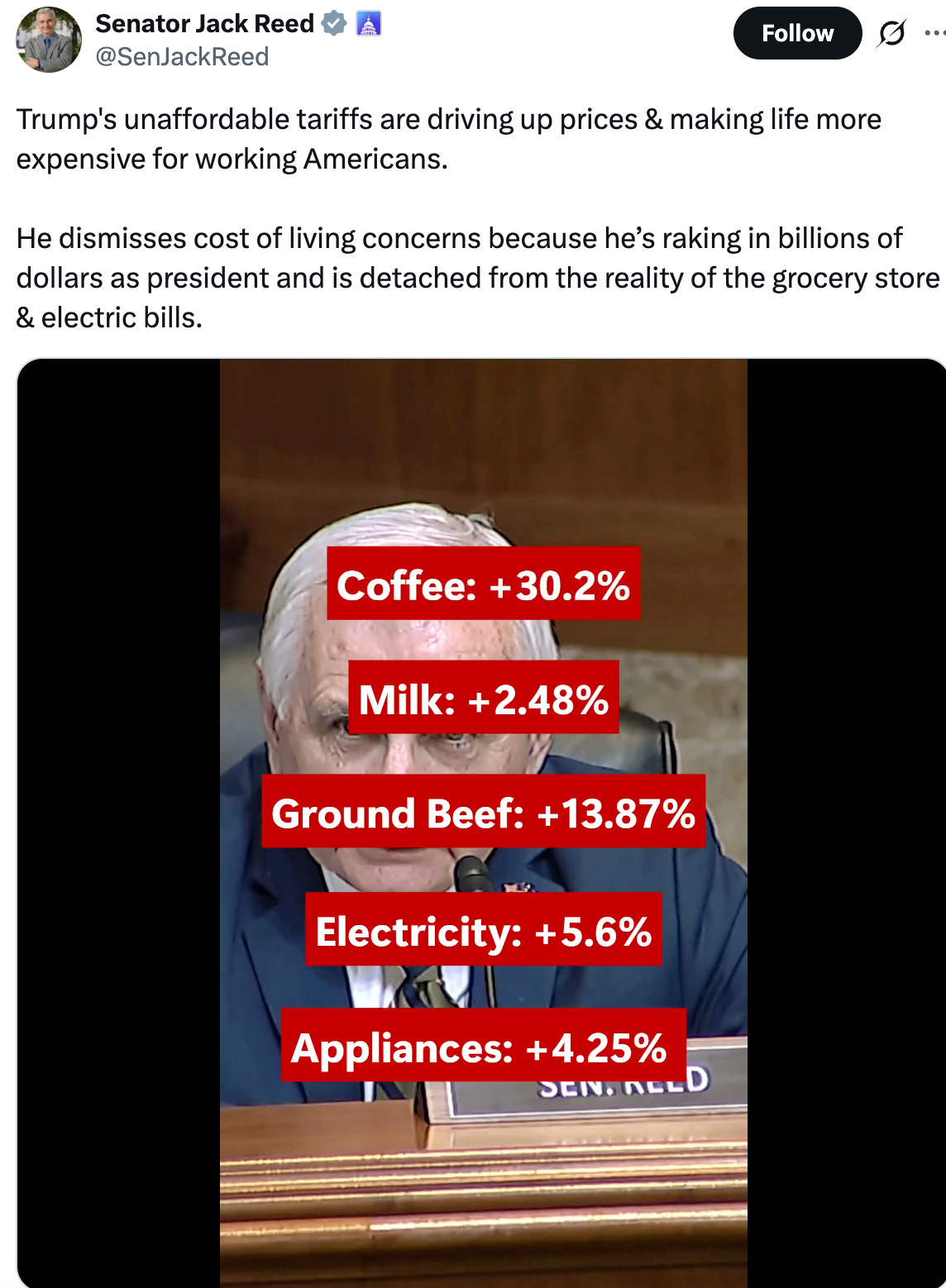

Calling out the real cost of goods!

While much of the Democratic Party was slow to message on affordability during the holiday season, Senator Jack Reed broke through by clearly highlighting who actually pays for tariffs—American consumers—and pointing to how tariffs are driving up prices on key holiday items like toys, decorations, and electronics.

That’s all for now! We will soon be taking some time off for the holiday break and will see you back in January!

The affordability issue is an opportunity. If Democrats want the wave election our democracy requires, they need a "big ideas" platform—not just outrage. That means rethinking Social Security so benefits can be received earlier in life, when family formation actually begins. Pair that with a national jobs program offering clear paths to the roles companies like Ford desperately need filled, and a robust abundance agenda that lets homes get built quickly. That's a coalition.