The government has shut down again, the 16th since 1981, and the timing couldn’t be worse: the IRS is unfunded at the start of tax season, the January jobs report is delayed right when markets need it most, and TSA officers are working without pay. But that’s just one piece of this week’s cost-of-living picture. We’ve also got Trump saying the quiet part out loud on housing, new research exposing work requirements as paperwork theater, a win for child care funding in court, and finally some genuinely good news on housing supply.

New Pro–CoL Developments:

Judge Blocks Trump’s Child Care Funding Freeze—For Now

What happened: A federal judge extended a ruling requiring the Trump administration to keep child care subsidies flowing to five Democratic-led states (California, Colorado, Illinois, Minnesota, and New York). HHS claimed “fraud concerns” but couldn’t tell the judge which media reports prompted the action or whether they targeted these states first and looked for justifications later. The judge called it “the cart before the horse.”

Why it matters: These programs serve 1.3 million children from low-income families nationwide and fund essentials like homeless shelters in NYC. The administration demanded states produce years of recipient data—including Social Security numbers—on an impossible timeline, then called it something other than a “freeze” despite their own press release using that exact word. It’s a preview of how funding threats may be weaponized against blue states, with vulnerable families caught in the middle.

Housing Market Shows Signs of Life—Finally

What happened: New listings went up 29% week-over-week and nearly 10% year-over-year, one of the strongest early-season weeks since before the pandemic. Total inventory is up 10.5% compared to last year, and pending sales are at their highest levels in years. Median list price held steady at $419,000.

Why it matters: After years of brutal supply constraints that locked out buyers, the market is finally moving toward balance. More homes on the market means more choices for buyers and less frantic bidding—without crashing prices. With mortgage rates steady near 6% and inventory rising, 2026 could be the first year of actual growth in existing home sales in years. It’s not a buyer’s market yet, but it’s no longer the seller-dominated frenzy that priced out so many families.

New Anti–CoL Developments:

Trump Says the Quiet Part Out Loud on Housing

What happened: Trump’s housing affordability push is already stalling—and he admitted why at a cabinet meeting: “We’re not going to destroy the value of their homes so somebody who didn’t work very hard can buy a home.” His own team’s proposals keep getting shot down by Congress, industry, or the president himself.

Why it matters: This is a clear signal that protecting existing homeowners’ equity takes priority over helping younger Americans break into the market. With home prices up 50%+ since pre-pandemic and the median first-time buyer now 40 years old, that’s a choice to side with those who already have wealth over those trying to build it. Meanwhile, 51% of voters say Trump’s policies have made life less affordable.

Government Shutdown #16: A Feature, Not a Bug

What happened: The government partially shut down (again) at midnight on Jan. 31 after Senate Democrats blocked a funding bill over immigration enforcement concerns. This is the fourth shutdown under Trump and the 16th since 1981, and the previous one, at 43 days, was the longest in U.S. history.

Why it matters: While politicians fight over DHS funding, real people pay the price: the IRS is unfunded at the start of tax season, the January jobs report is delayed, TSA officers and disaster workers are showing up without paychecks, and small business loans have stopped. Social Security checks still go out, but the staff who help people enroll or update their information get furloughed. This is a reminder that while these shutdowns seem abstract, it hits families trying to file taxes, get passports, or access federal services they’ve already paid for.

Jobs Report Delayed, Right When It Matters Most

What happened: The Bureau of Labor Statistics won’t release the January jobs report on Friday as planned due to the shutdown. All data collection, processing, and dissemination is suspended until funding resumes.

Why it matters: This report was set to include annual revisions expected to show job growth was weaker than initially reported. Markets and policymakers are flying blind on the labor market at a critical moment, another real-world cost of congressional dysfunction.

SNAP Work Requirements Expand—Despite Research Showing They Don’t Work

What happened: Work requirements are now kicking in for more SNAP recipients: adults 55-64, parents of kids 14+, and formerly exempt groups like homeless individuals, veterans, and foster youth aging out of care. Recipients must show 80 hours/month of work, training, or volunteering—or lose benefits after three months. The CBO estimates 2.4 million people will be cut from the program over the next decade.

Why it matters: New research confirms these requirements don’t actually increase employment, they just kick people off food assistance. A January 2026 NBER paper found work requirements increased benefit denials by 8 percentage points (a 22% jump), driven by administrative burden rather than people choosing not to work. When requirements are waived, the effect disappears. Meanwhile, nearly 2 in 5 SNAP households already include someone with a job. This is a policy designed to shrink the rolls, not help people find work.

Win of the Week!

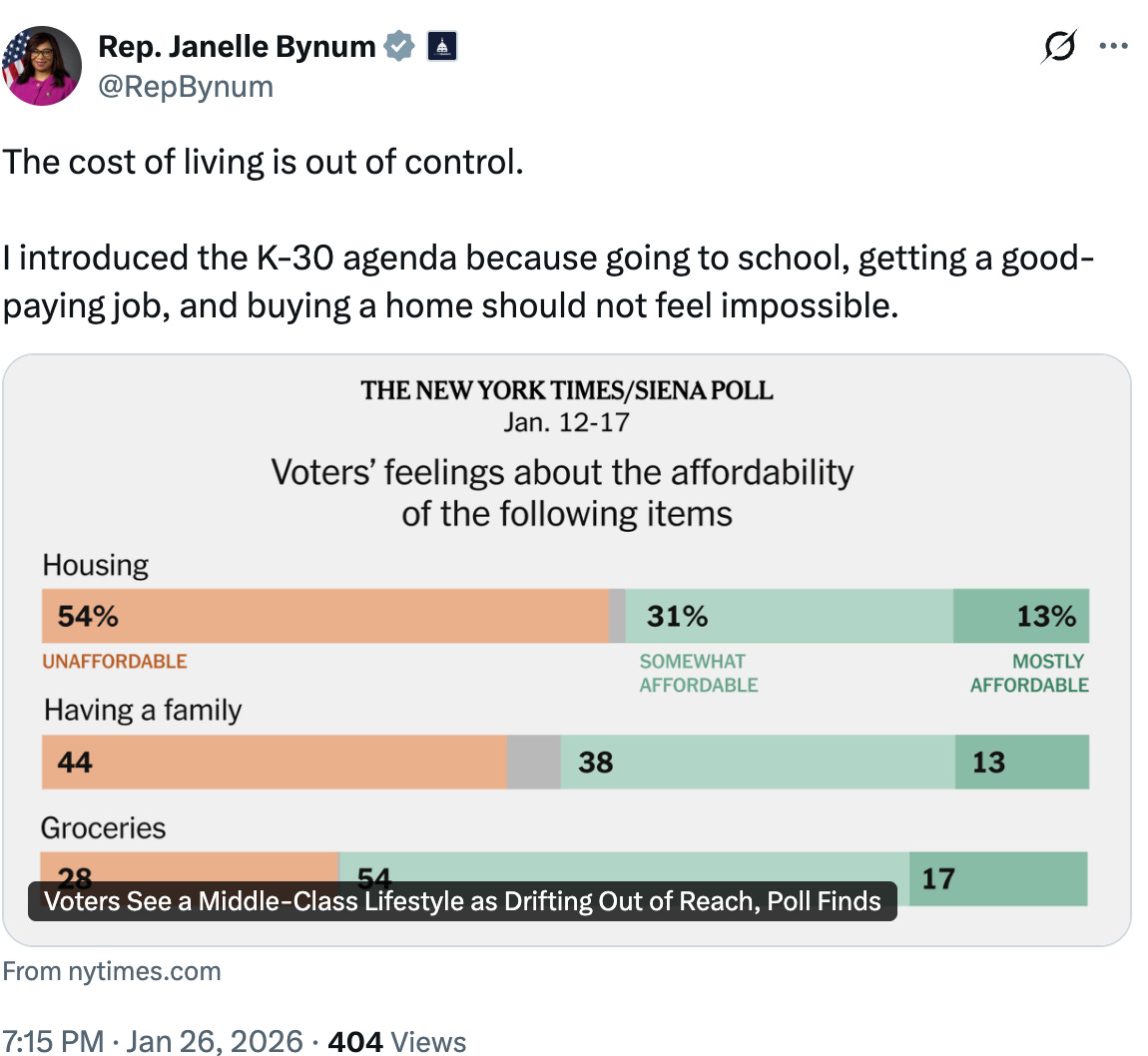

Image Credit: Janelle Bynum

Win of the week goes to Rep. Janelle Bynum (D-OR) for launching her “K-30” agenda, a 16-bill package tackling the trifecta squeezing young Americans: housing, education, and jobs. The housing bills are especially notable, including grants to offset developer fees, matching funds for first-time homebuyer savings, and funding for pre-approved building designs to speed up construction. Seven of the 16 bills have bipartisan co-sponsors, signaling these issues can still cut across party lines.

That’s all for now! See you in two weeks and stay warm everyone!