It's the Biggest Housing Bill in Decades

And somehow we aren’t really talking about it?

What happens when a deep-red Republican and a progressive Democrat team up on housing? We get something pretty wild: a massive bipartisan housing package that everyone is calling the biggest deal in decades. The Renewing Opportunity in the American Dream (ROAD) to Housing Act of 2025 passed the Senate Banking Committee unanimously (24-0), signaling unprecedented political alignment on America's housing shortage. And yes, Senator Tim Scott (R-S.C.) and Senator Elizabeth Warren (D-Mass.) are leading this together. No, that’s not a typo. And yes, they actually agree on something: America needs more housing, and less red tape holding it back.

What’s Driving the Housing Emergency?

America is facing a housing emergency that transcends political boundaries. If construction had continued at 1980s-1990s rates, the nation would have 15 million more housing units today. The shortage affects every state. That shortfall helps explain why whether you’re in California or the Carolinas, rents and home prices feel out of control.

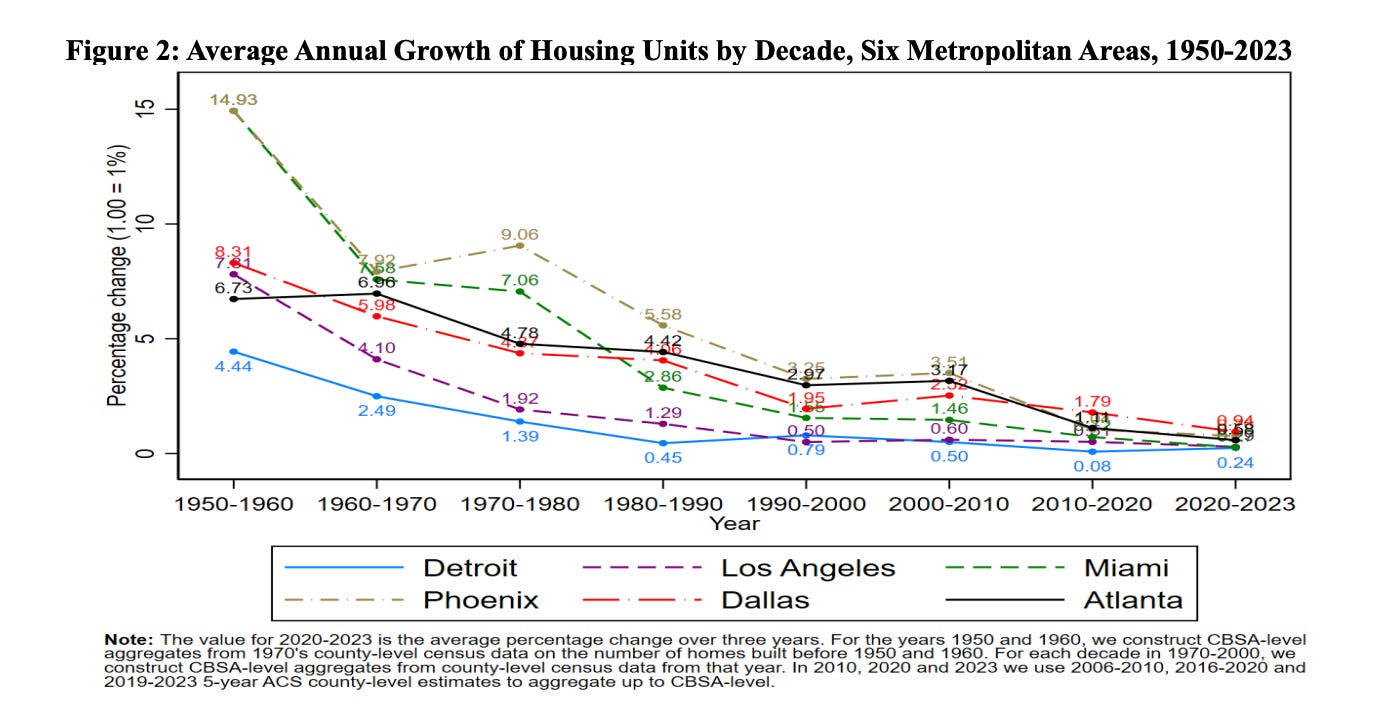

Consider some facts: every single state – red, blue, or purple – has a shortage of affordable housing for its lowest-income residents. The worst gaps are in places like Nevada, Arizona and Texas, not only in California. (Nevada has only 17 affordable rentals for every 100 deeply poor renter households, and even “best-case” North Dakota has just 62.) And even middle-class housing is getting tighter in historically “cheap” markets. Harvard economists Edward Glaeser and Joe Gyourko find that formerly boomtown cities of the Sunbelt – think Phoenix, Miami, Atlanta, Dallas – were once building homes like crazy but have now seen construction “decreased and converged across these and many other metros,” with prices rising fastest where new supply fell the most. Basically, places that used to be safe affordable havens are now starting to look more like the expensive coastal markets. As they put it, “Miami has become far more like Los Angeles.” And one of the biggest culprits comes from the elite insiders who block new housing from getting built in their neighborhoods.

Image Credit: NBER

What’s Inside the ROAD to Housing Act

Let’s break down what’s actually in this behemoth. Since there are 46 total provisions in this bill, the best way to dive into this can be broken up in five separate lanes I will break down below:

1. Cutting Zoning Red Tape: The bill tackles the notorious local land-use barriers that drive housing costs up. It directs HUD to develop best-practice zoning frameworks for states and cities, basically a federal playbook on how to modernize outdated codes. No, Washington isn’t mandating new zoning; rather it’s naming and shaming the worst offenders (like excessive parking mandates or bans on granny flats) and guiding communities to loosen up. It also includes the Build More Housing Near Transit Act, which rewards cities that reduce parking minimums or allow denser housing along transit lines – those cities get bonus points when vying for federal transit funds. The message: if your metro builds apartments instead of a parking lot next to the new train station, you have a much higher chance of getting your grant application approved!

2. Incentives to Build, Baby, Build: Perhaps the boldest idea is tying some federal housing dollars to housing production outcomes. Not promises, not nice-sounding language, outcomes. The Build Now Act in the package would tweak HUD’s formula funding (like Community Development Block Grants) to penalize communities that are dragging their feet on homebuilding and reward those that get shovels in the ground Specifically, jurisdictions with lagging housing growth could see a modest cut (~10%) in CDBG funds, while high-performers get that money as a bonus. It’s a novel carrot-and-stick approach – essentially “scoreboard politics” for housing: cities can no longer NIMBY-out without budget consequences. This is federal muscle on land use the likes of which we haven’t seen in generations. (The feds haven’t leaned into zoning like this since they wrote the Standard State Zoning Enabling Act in the 1920s!)

3. New Programs and Pilots: ROAD 2025 isn’t just about removing barriers; it also pumps resources into building and preserving homes. One major addition is a $200 million per year Housing Supply Innovation Fund. This competitive grant pot will reward cities and tribes that actually increase housing supply – not just plans. We have moved past the need for just good rhetoric. Winners can use funds to upgrade infrastructure or expand things that further boost housing (updated sewer lines or financing for modular construction) There’s also a new pilot for Whole-Home Repairs, modeled on a successful Pennsylvania program: it would give grants or forgivable loans to low-income homeowners/landlords to fix up aging homes (think leaky roofs, old electrical, accessibility upgrades). Another pilot aims to convert vacant or abandoned buildings into housing, turning blight into apartments. And in a move long sought by mayors, the bill would permanently authorize the Disaster Recovery Community Development Block Grant Programs program – no more waiting for Congress to approve relief after every hurricane or wildfire, HUD will have a standing program to speed up rebuilding. It even creates a new Office of Disaster Management and Resiliency to get those funds out the door faster.

4. Boosting Financing & Homeownership: This section tweaks the financial plumbing to get more homes built and bought. First, it raises the cap on banks’ public welfare investments (think: affordable housing, community development projects) from 15% to 20% of assets, unlocking billions in private capital for housing finance. It also updates the Federal Housing Administration lending rules to support manufactured homes and here’s where things get interesting. One of the most impactful changes is the removal of a long-standing, little-known federal rule that required manufactured homes to be built on a permanent steel chassis. Yes, like a trailer. Even though they’re not meant to move. Even though nobody tows them. Even though it adds $5,000 to $10,000 to the cost of each home for no practical reason. As Gary Winslett put it, this was “the dumbest rule you’ve never heard of.” ROAD 2025 finally strikes that language from federal code a simple fix with big consequences: cheaper homes, more financing options, and more dignity for the working-class families who rely on this housing.This change opens the door for modern, multistory prefab homes that actually resemble traditional houses and it removes a key obstacle to appraising, insuring, and financing them fairly. It’s progressive deregulation at its best. Beyond that, the bill includes provisions to promote small-dollar mortgages (so buyers in low-cost areas aren’t iced out of the market) and to expand ADU financing (so your garage apartment or backyard cottage might actually get bank-funded). While ROAD 2025 doesn’t touch tax policy directly (that lives elsewhere), it aligns with broader efforts to expand the Low-Income Housing Tax Credit and potentially bring back a first-time homebuyer tax credit down the road. In short, this is a full-court press to unlock capital at every level — from big banks to first-time buyers — and put that money to work building homes.

5. Streamlining and Accountability: True to its bipartisan nature, the bill also goes after bureaucratic bloat. It would streamline environmental reviews for housing, expediting projects that are small or built on infill sites. Essentially, building a duplex on a vacant city lot shouldn’t trigger the same lengthy National Environmental Policy Act (NEPA) process as building a highway – and under this law it won’t, thanks to expanded categorical exclusions for modest infill developments. The bill also lets states assume some of HUD’s environmental review responsibilities to speed things up. Other red-tape cutters: simplifying HUD inspections, expanding the pool of qualified appraisers (to address appraisal bottlenecks), and forcing better coordination among federal housing programs. On oversight, it reauthorizes and reforms legacy programs like HOME (the main federal block grant for housing) with an eye to performance, and even steps up accountability for HUD and USDA housing regulators to actually deliver results. There’s also a tranche of homelessness program reforms consolidating and modernizing HUD’s homeless assistance grants, and launching a demonstration that partners housing providers with health care services to get chronically homeless folks into stable housing with support. The common thread: make existing dollars work better and make agencies work smarter.

The bill itself has a vast amount of provisions from rural rental preservation (shout-out to the Rural Housing Service Reform tucked in there) to veteran housing programs; nearly every senator on the Banking Committee got one of their pet projects included. This was key to securing broad buy-in: everyone’s district gets a win. Rust Belt cities get help rehabbing old homes; Sun Belt suburbs get relief from zoning chokeholds; rural communities get help preserving aging USDA housing stock. It’s a big tent approach to a big problem.

The Road Ahead: Challenges and Impact

As exciting as ROAD 2025 is, a reality check: a committee victory isn’t the same as law. The bill now heads to the full Senate, where it will need floor time (and continued bipartisan love) to pass. Even if some details get trimmed or negotiated down, the core ideas of ROAD 2025 seem likely to endure because they’re popular. After all, what governor or mayor wouldn’t want new grants for development, or flexibility to streamline projects, or help for first-time buyers? And just how popular are these ideas? We’ve got a whole piece breaking down the latest housing reform polling and the short version is: voters want action. From zoning reform to modular construction to small-dollar mortgage access, housing abundance has quietly become one of the most bipartisan issues in the country.

The bigger risk might come from extremes at both ends: Some progressive groups worry the NEPA streamlining could bypass environmental justice, or that tying funds to housing production might punish struggling cities. On the right, a few might bristle that the feds are meddling in local affairs or spending too much (though notably, this bill doesn’t blow out the budget – it’s more policy changes than huge new spending). So far, though, those voices have been surprisingly muted. The unanimous committee vote included some very conservative and very liberal senators, which shows any objections were mollified.

ROAD 2025 is a signal that the political logjam on housing is finally cracking. Now, we have a blueprint (and some cash) to start building our way out. It won’t solve the crisis overnight – no single bill can – but it reshapes the playing field. If cities respond, if nimble developers seize new opportunities, if public and private capital flows into new homes, this could mark the start of a true housing turnaround.

We have come off of a Biden administration that made historic investments through sprawling legislation like the Inflation Reduction Act, but often stumbled on implementation (the case of the billions of funding into EV charges, with an incredibly slow roll out, comes to mind). The Trump era, by contrast, has instead placed culture wars and a love of tariffs ahead of the housing crisis (which makes construction materials more costly).

Image Credit: BPC

Congress now has a rare shot to actually deliver on what voters across the spectrum say is their number one economic concern: the cost of housing. And if not? Well, at least we’ll know Washington tried something big but targeted at the same time. That is incredibly rare.

It’s a great bill, but I think it’s a good thing it’s not getting a lot of media coverage. It may be another example of what Matt Yglesias has called Secret Congress. The less attention it gets, the less likely it is to be attacked by partisans and the more likely it is to get enacted.

I wrote a piece on it! But yeah, I noticed nobody else really was picking up on it. Probably since it's got a ways to go, still?